Rising from the ashes of

the Great Fire of Tooley St.

A salamander, a mythical lizard-like creature which could not only live in fire but extinguish the flames.

Although this fire mark variant was mainly for use overseas and as a promotional item, a few specimens are known in situ in England.

View slides

Warehouse insurance tariffs rise

The Tooley Street fire had consumed 1000 tons of hemp, 3000 tons of sugar, 500 tons of saltpetre, 5000 tons of rice, tea, spices and other items of merchandise (mercantile risks). Over 21,000 square yards of warehouses were totally destroyed. The loss amounted to between £1 million -£2 million pounds, which in today’s terms would represent hundreds of millions. It was a staggering blow to the insurance market.

The fire offices stopped insuring riverside properties at the existing rates of premium, on the grounds that the majority of them had paid scant attention to Braidwood’s fire safety recommendations.

The rates (mercantile tariffs) for fire insurance on riverside properties thus rocketed by up to 300%. The warehousemen, wharfingers and merchants rose up in outrage. The insurers promised to review their rates, but only when the huge warehouses had provided acceptable subdivision of risk and attended to other recommendations that Braidwood had been struggling to achieve over many years.

Tooley Street fire, image courtesy of the Aviva Group Archive.

The Commercial Union is formed

Protests were made to the mercantile tariff companies about the high premiums, but no satisfactory compromise was reached. At a meeting of prominent merchants and brokers held on 5 August 1861, it was decided to form a new company with a capital of £2,500,000 to underwrite mercantile risks at ‘fair’ rates.

The venture quickly got underway and on 28 September the Commercial Union Assurance was officially established as a joint-stock company.

The Commercial Union took much business from old-established companies insuring wharves and warehouses, and the rating introduced by the company undercut the whole range of the tariff system except over extreme risks.

There followed two years of struggle for supremacy in mercantile insurance, until an agreement was eventually reached in November 1863 between the Commercial Union, the tariff companies and the northern companies for an amended London mercantile tariff.

The company did well in the life and marine department, but the fire business suffered heavy losses. In 1865 the fire fund was so depleted that it had to be topped up with £25,000 from the reserve fund, and the company failed to pay a dividend that year. The fire business made erratic progress until the late 1880s, when it increased steadily. In 1865 fire premium income was £53,000, in 1870 it was £190,000, in 1884 it was £591,700 and by 1890 it had risen to £1,183,000.

Agencies and branches were established in the United Kingdom and worldwide and many smaller companies were taken over – among them the Hand in Hand Fire and Life Insurance Society and the Union Assurance Society – until the Commercial Union became one of the largest British insurance groups.

Commercial Union instructions for overseas agents. Image courtesy of the Aviva Group Archive.

The rise of Regional insurance companies

The fire offices continued to expand, notably in the big cities outside of London, who used existing business connections to grow their market overseas.

Insurers based in big cities outside of London, such as Liverpool, Leeds and Manchester used their mercantile and trading connections to become important players in international markets. From the 1860s, Liverpool became a centre for fire insurance that was on an equal footing with London and by 1914 only two of the UK’s largest fire insurance companies were based in the City of London.

Liverpool Fire and Life Insurance was founded in 1838 by a local cotton broker and a banker, in response to increased premiums from the London firms. It became the largest fire insurer in the world through a series of acquisitions overseas in the 1850s and 1860s. It used its network of agents to expand its business, including in New York, Newfoundland, Shanghai, San Francisco and Hamburg. In 1864 it acquired The Globe of London, changing its name to Liverpool and London Globe Insurance.

By the 1860s, it was the third largest insurance company in the US by premium income, but this left it exposed to substantial fire claims. It suffered a string of calamitous losses in 1871 including the great Chicago and Boston fires.

As with all other UK insurers, it met all its claims in full, enhancing its reputation.

An insurance policy from The Liverpool & London Fire & Life Insurance Company, image courtesy of the CII Archive

New provincial insurers

Words by Brian Wright. Insurance company fire mark images courtesy of the CII Archive

The Berkshire, Gloucestershire and Provincial Life and Fire Assurance Company

READING 1824-1831

Shareholders other than directors were limited to thirty shares each and were required to insure in proportion to their holdings, with minimum amounts of £50 for life assurance and £300 for fire insurance. Failing to do this led to a fine of 22s per share.

Read more...The Earl of Craven was patron, being succeeded by the Duke of Gloucester, and there were six vice-patrons and sixteen trustees and directors.

The life business passed to the Clerical, Medical and General Life Assurance Society in 1829. Duty collected on the fire business rose from £379 in 1824 to £2,600 in 1830. In 1831 the company passed to the Phoenix Assurance Company.

Emblem: A castle - most probably Windsor Castle - with an ensign flying from the tower. Alternatively, it has been suggested that it is Reading Castle, now destroyed. The motto, Salus, means 'Soundness'.

The East Kent and Canterbury Economic Fire Assurance Association

CANTERBURY 1824-1828

The company had a very short life span, during which time it made little impact on the fire insurance market. In 1825 its duty returns amounted to £1,310 and by 1827 these had risen to only £1,919.

Read more...In 1828 negotiations began for the sale of the business to the Phoenix Assurance Company which culminated in the Phoenix agreeing to pay £8,048 18s 9d for the assets of the company, a house and premises in Canterbury, three fire engines and 'goodwill', less £800 to cover unexpired liabilities. The Economic passed to the Phoenix on 12 July 1828.

The Essex Economic Fire Office

CHELMSFORD 1824-1857

Nothing is known about its business history and in 1857 it passed to the Manchester Fire and Life Assurance Company.

Emblem: An heraldic crown based on St Edward's Crown made for the coronation of Charles II in 1662.

The Hertfordshire and Cambridgeshire Fire Office

HERTFORD

This company was formed when the directors of the Hertfordshire, Cambridgeshire and Country Fire Office had a serious disagreement leading to the resignation of half the board. The exact nature of this dispute is not known.

Read more...Mr Andrews, a timber merchant of Hertford and founder of the Hertfordshire, Cambridgeshire and Country, was one of the members who resigned, and he and the other ex-members of the board formed another insurance company, the Hertfordshire and Cambridge Fire Office, which also operated from premises at Hertford.

This company traded in opposition to the original one, but it was not very long before the directors of both companies settled their differences and an amalgamation of the two took place, the combined company passing to the Phoenix Assurance Company in 1831.

The exact dates when this breakaway company operated are uncertain, as is the length of time it undertook business, but it obviously existed long enough to have a fire mark designed and a batch manufactured and distributed.

The Hertfordshire, Cambridgeshire and Country Fire Office

1824-1831

Like many of the multitude of other fire insurance companies formed about this time, it transacted business only within a fairly limited area.

Fire brigades were maintained and fire engines presented to towns where business considerations justified the cost.

The company's short career was made more turbulent by a boardroom rift, after which a breakaway group of directors formed a rival company, the Hertfordshire and Cambridge Fire Office. The differences were eventually settled and the two companies amalgamated.

In 1831 the company passed to the Phoenix Assurance Company.

Emblem: Based on the arms of Hertfordshire (upper half) and Cambridge (lower half). Trees and water represent the woods and rivers of Hertfordshire and the deer forms a pun on the name, since it is a hart fording a river. The arms of Cambridge depict royal and national symbols above a representation of a fortified bridge. The ships and seahorses commemorate maritime connections since Cambridge is the highest navigable point on the river Cam. The crest represents Cambridge Castle.

The Lancashire Insurance Company

COMING SOON

The Manchester Fire Assurance Company

1824-1904

It was decided to extended business to towns outside of Manchester and a network of agencies set up, but only directors at Manchester had the power to grant policies. During the first five years every shareholder, on threat of forfeiture of his shares, had to take out a policy with the company.

The company formed a brigade in Manchester in its first year, and by 1825 had brigades in other major centres such as Liverpool.

The company increased its premium income and sphere of influence by taking over the business of the Star, Legal and Commercial, and Essex Economic between 1854 and 1857.

In 1861 the company suffered a £70,000 loss through the Tooley Street fire. In 1863 it established its first overseas agency in Hamburg. The company continued to make steady progress until 1890, when the directors decided to open a branch office in the United States and the business rapidly expanded both at home and overseas.

The company passed to the Atlas Assurance Company, after a series of fires had caused serious losses in 1904.

Emblem: It is based on the arms of Manchester. The arms are derived from those of a local family, the Byrons.

The Leeds and Yorkshire Fire and Life Insurance Company

LEEDS 1824-1864

The company was formed to transact fire, life and annuity business. Within its fairly short life span, it formed fire brigades in Leeds, Bradford, Halifax, Huddersfield and Wakefield, 'with engines of the most powerful construction, with every apparatus for the speedy extinction of fires”.

Read more...A fine example of one of their fire engines, built by Tilley & Co. has been preserved at the Castle Museum, York. This engine was one of the largest types of manual engine, requiring sixteen men a side to operate the pumps; and, since they worked in relays, it took sixty-four men to maintain the pumping. With the engine is a pole for a pair of horses, and shafts for a single horse. There are four buckets for priming the pump, a leather suction hose and a megaphone for the brigade chief.

The business of the Leeds and Yorkshire passed to the Liverpool and London Fire and Life Insurance Company in 1864.

Emblem: Based on the arms of Leeds and Yorkshire. A fleece, shown heraldically as a ram suspended, represents the woollen industry, which was of great importance to Yorkshire from the medieval period. The rose was a symbol of the royal house of York.

The Yorkshire Fire and Life Insurance Company

YORK 1824-1967

The company was established on 26 July 1824 by prominent York citizens who were worried about the amount of money being paid to insurance companies from London and Scotland. There were at this date at least eighteen different agencies in York, and it was felt that the time had come to form their own local company. To acquire more business the company would deliberately undercut its rivals, a practice to which the latter objected.

Read more...The Yorkshire ordered its first engine, painted in blue and red with the company's name on it, from Hadley & Co. of London in April 1825.

The company, after considering a joint brigade with the Corporation, set up an engine establishment consisting of an engineer, foreman and ten firemen, all part-time. They attended their first fire in May 1825.

From temporary housing, the engines were transferred to a specially constructed engine house in New Street built in 1828. Since the city had two insurance brigades by 1837 (the Yorkshire and the York and North of England), the Corporation decided to sell all its engines except one. The Yorkshire decided to discontinue its brigade in 1875, when the Corporation took over responsibility for this and purchased its engines and other equipment.

The Yorkshire appointed its first agent at Beverley in August 1824 and at Hull in September. By 1830 about a hundred agents had been appointed in Yorkshire, Lancashire, Lincoln, Newcastle, Aberdeen, Edinburgh and other centres in the North and Midlands with two agencies in the South at Bath and Chichester. By 1836, the agency network had spread over the whole country, but the company would transact life business only in London.

The profits varied greatly from year to year, but the company was always able to pay a generous dividend to its shareholders.

The company's head office was always at York, but in 1875 various branch agencies were opened, and in 1880 a London branch was established. The company continued to expand its business, entering the overseas market in 1898 with the appointment an agent in Amsterdam. In November 1967 the Yorkshire merged with the General Accident Fire and Life Assurance Corporation.

Emblem: York Minster.

The Western Fire Insurance Company

MANCHESTER 1863-1868

This company, of which little is known, was not particularly successful and towards the end of 1867 entered into negotiations with the Alliance, British and Foreign Fire and Life Insurance Company, which wanted to take over the business.

Read more...The Western had an office in London as well as its head office in Manchester, but it was only the lease of the Manchester office that was taken over by the Alliance.

Liverpool, London and Globe

COMING SOON

The Surrey and Sussex Fire and Life Assurance Company

SOUTHWARK 1825-1826

Soon after its foundation, the company changed its name to the Surrey and Sussex and Southwark Fire and Life Assurance Company. A uniformed fire brigade was maintained and the company had an office at the building used by the Protector Fire Insurance Company adjoining the Town Hall in Borough High Street, Southwark.

Read more...The company had close links with the Protector, one of its directors, Richard Price, being on the board of both companies. The fire and life departments were kept distinct and the capital of the company was invested in the names of the trustees.

A proposal of the Surrey and Sussex stipulated that any claimants of the company had the right to state their claim personally to the court of directors, and if dissatisfied could have their demands 'submitted to reference'.

The company was wound up in 1826. Its fire business was taken over by the Protector, while the life business probably formed the basis of the Protector Life, a company set up that year to conduct business in association with the Protector Fire Insurance Company.

Emblem. An ancient symbol for Southwark, its origins are unclear. The cross is thought to represent the parish church of St George the Martyr and is commonly called the 'Southwark cross'.

The Sussex County and General Fire and Life Assurance Company

BRIGHTON 1825

The Sussex County advertised that it had a capital of £500,000 and charged the lowest rate of premiums of any contemporary office, paid rent for accommodation to policyholders who suffered loss by fire, insured farming stock at 2s per cent, made no charge for endorsing or altering policies, and would make good damage caused by lightning.

Read more...A fire brigade was maintained which was uniformed and well supplied with a fire engine, escape and other firefighting equipment. The Sussex County had a very short existence and the firemen attended only one fire - on 12 September 1825 at Major Russell's mansion in Portland Place, Brighton.

Emblem. It is based on the arms of Brighton. The dolphins represent the sea. Brighton (previously called Brigh-thelmeston) had been made popular as a resort by the Prince Regent in the early nineteenth century.

The District Fire Office

BIRMINGHAM 1834-1864

Established with a capital of £300,000 and operating from a head office at 61 New Street, the company had a lot of local support and a large number of patrons, among them the Queen Dowager.

Read more...Little is known of the progress of the company or its business history. The company had a fourth class of 'special risks' which comprised various hazardous properties, or buildings used for particularly hazardous trades.

In 1851, the company adopted the title of the District (Birmingham) Fire Insurance Company and is believed to have underwritten only fire insurance. In 1864 Robert Lewis of the Alliance, British and Foreign Fire and Life Insurance Company began negotiations for the acquisition of the District, whose annual premium income then amounted to £9,165. The outcome was successful and the company passed to the Alliance the same year.

Emblem. It is based on the arms of Birmingham, which are derived from those of the de Birmingham family, who had a castle on the site of Birmingham in the early medieval period.

The Leicester Fire Office

LEICESTER 1834-1843

This company was originally formed to transact fire insurance in Leicestershire, but soon added life assurance to its business and adopted the title Leicester Fire and Life Insurance Company. It acquired business in the surrounding counties and subsequently changed its name to the Leicestershire and Midland Counties Insurance Company, although it continued to use the name Leicester Fire Office on some documents throughout its existence.

Read more...Its head office was at Leicester, and agents were appointed in various Midlands towns. It maintained two fire engines at Leicester, with thirty firemen, equipped with helmets and jackets. There was another engine at Loughborough, housed in a building provided rent free by Mr Werner. The firemen were paid for attendance at fires but also received £3 12s a year for 'exercising' the engines.

The life business passed to the Clerical, Medical and General Life Assurance Society in 1840, and the company transacted only fire insurance until the business was transferred to the Sun Fire Office in October 1843.

The York and North of England Fire Insurance Company

COMING SOON

The Nottingham and Derbyshire Fire and Life Assurance Company

NOTTINGHAM 1835-1869

The company originated from a meeting held at the Flying Horse Inn, Nottingham, on 19 October 1835, where it was decided that a local fire and life insurance company should be formed, and that business should start from Christmas of that year. By September 1836, the company was using the title of the Nottinghamshire and Derbyshire Fire and Life Assurance Company.

Read more...Details of fire brigades maintained are not readily available, but the Derbyshire Courier of 30 September 1843 records a fire at the brickyard of Mr Henry Bunting at Calow, Derbyshire, to which the Nottinghamshire and Derbyshire fire engine, stationed with Mr Josiah Robinson of Chesterfield, draper and agent of the company, was speedily despatched, being soon followed by the four town engines.

The business of the company was not restricted to Nottinghamshire and Derbyshire, and there are still marks in situ on farm buildings in Lincolnshire and Staffordshire, but the company had no overseas business.

In 1869 the company ceased to underwrite insurance, its life business passing to the Imperial Life Insurance Company and its fire business to the Imperial Fire Insurance Company.

Emblem. Based on the arms of Nottinghamshire. The ragged cross represents the medieval hunting preserve of Sherwood Forest, and the crowns indicate its associations with royalty.

The Shropshire and North Wales Assurance Company

SHREWSBURY 1836-1890

This company was established by a deed of settlement dated 26 November 1836. There was a share capital of [100,000 in 5,000 shares. The managing director and all general and local directors were each required to hold twenty shares.

Read more...In 1844 life assurance business was transferred to the Legal and General Life Office, the company from then on restricting its business to fire insurance.

The company amalgamated with the Alliance, British and Foreign Fire and Life Insurance Company in 1890, the same vear as the Salop Fire Office. Its fire brigade was merged into a combined Salop-Shropshire and North Wales and Alliance Fire Office Brigade, the engine being stationed at Mr Franklin's Livery Stable on Swan Hill, Shrewsbury, the old Salop Fire Office engine house. This brigade remained in existence until 1918, when responsibility for fire-fighting was given to the borough police force.

Emblem. Three ostrich feathers and a coronet form a badge which has been used by the Prince of Wales since the time of Edward the Black Prince.

The Hampshire and South of England Insurance Society

WINCHESTER 1841-1847

Founded under the above title, the company later adopted the name South of England Insurance Societv but also used the title South of England Insurance Company.

Read more...The society transacted both fire and life insurance, and established a network of agents in towns and cities throughout southern England between Bath and Brighton and including the Isle of Wight. Little is known of the business history of the society, but larger risks would be reinsured with other companies, usually the Royal Farmers and General Fire and Life Insurance Institution or the West of England Fire and Life Insurance Company.

In August 1847 the fire business of the society was transferred to the Sun Fire Office for the sum of £350 and the life business to the Britannia Life Insurance Company.

Emblem. A red rose, granted to Hampshire, formerly Southamptonshire, by John of Gaunt, Duke of Lancaster,

Royal Insurance Company

COMING SOON

The Queen Insurance Company

COMING SOON

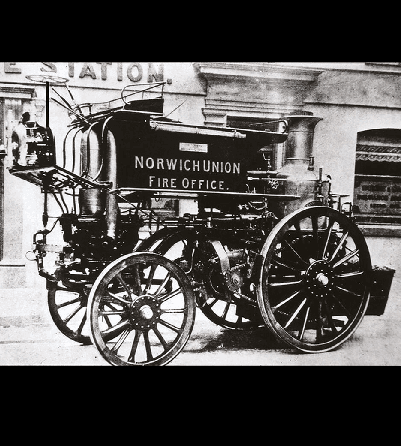

The Liverpool and London and Globe Insurance Company

LIVERPOOL 1864-1919

This combined group of companies had its origins in the Liverpool Fire and Life Insurance Company, which in 1847 absorbed the London, Edinburgh and Dublin Insurance Company and assumed the name Liverpool and London Fire and Life Insurance Company.

Read more...The Liverpool and London took over the Globe Insurance Company and was renamed the Liverpool and London and Globe Insurance Company. The original London office of the Globe was at 1 Cornhill and it was through taking over the Globe that the company came into possession of such an important London site.

In 1871 the company was severely hit by the Chicago fire - indeed, it sustained the largest loss of any English insurance company involved with that conflagration. It enhanced its reputation in the United States by immediately telegraphing its agent in Chicago to draw as required $2 million, the full sum of estimated liability. In 1872 a fire at Boston cost the company a further £280,000.

By 1871 the fire premiums had reached £1,131,594 and the losses, as a result of the Chicago fire, were £1,178,794. In 1872 the figures were £1,258,584 and £1,071,493 respectively, and there was no dividend paid to the shareholders. However, within a few years the company had rebuilt its finances and continued to expand its market both at home and overseas, particularly in the United States, to become one of the largest British insurance companies.

Fire brigades were maintained in several towns and cities, the last one, at Gloucester, being disbanded in 1912.

In 1919 the company was acquired by the Royal Insurance Company, since such a move was felt to be useful in expanding both companies' business and giving greater security.

Emblem. A combination of the emblems used by the Liverpool and London Insurance Company and the Globe Insurance

The Mutual Fire Insurance Corporation, Manchester

MANCHESTER 1869-1890

The company was founded with a guarantee fund of £100,000 subscribed by wealthy merchants and manufacturers in Lancashire and Yorkshire who were dissatisfied with the tariff rates charged for woollen and cotton mills.

Read more...At first the company's business was mainly among the mill owners of Lancashire and Yorkshire, and the scheme particularly appealed to owners of industrial premises owing to a novel feature of its cover, a discount to policyholders who protected their property by appliances for halting and preventing fire. There was an immediate inducement to adopt measures for minimising fire loss, and also an encouragement to produce more reliable means of protection. The Mutual was one of the main companies responsible for introducing sprinklers into factories and warehouses.

The company was financially very successful and in 1877 extended its business to cover all types of fire risk throughout the United Kingdom. The company was at times obliged to grant policies for larger amounts than the directors thought prudent to carry alone, and these surplus risks were reinsured, the Mutual receiving a commission of 14 per cent. In 1877 some £43,786 was paid by the company to other underwriters.

The Mutual continued to operate as one of the last large mutual insurance societies until 1890, when it passed to the Palatine Insurance Company.

Emblem. Based on the arms of Leicester. The pimpernel, a wild flower, is derived from the arms of the Earl of Leicester.

The Equitable Fire Insurance Company

MANCHESTER 1873-1901

The company was established to transact fire insurance with a capital of 500,000 in 100,000 shares of £5 each. It later added accident insurance to its portfolio and was renamed the Equitable Fire and Accident Insurance Company. The company operated both in Britain and overseas and had important connections in Egypt, its agents being Nathan & Co. of Alexandria.

Read more...

In 1901 the company passed to the London and Lancashire Fire Insurance Company, which wanted to acquire not only its fire insurance business but also its accident portfolio, which it found very attractive. In 1901 the Equitable's fire premium income amounted to £160,000, mainly from industrial risks in Lancashire and Yorkshire. Its accident premium income at that time amounted to £50,000.

Mr Henry Harrison, chairman of the Equitable, joined the board of the London and Lancashire in 1901, when the accident business of the Equitable was used as the base for setting up an accident department by the London and Lancashire.

Emblem. Justice blindfolded and holding sword and scales.

New Scottish & Irish insurers

Words by Brian Wright. Insurance company fire mark images courtesy of the CII Archive

The Scottish Union Insurance Company

EDINBURGH 1824-1878

English insurance companies controlled a considerable proportion of Scottish insurance in the first quarter of the nineteenth century, and although there were some Scottish fire insurance companies Alexander Henderson, Lord Provost of Edinburgh and Master of the Merchants' Company, realised there was room for another. Henderson was the prime mover behind the formation of the Scottish Union.

The company began with great enthusiasm, working from apartments in Prince's Street, and receiving support from all classes of the community since it insured property of all descriptions and offered a broad base of insurance cover.

Rates were as low as was compatible with safety, according to the nature and extent of the risks in each particular case. The company stationed fire engines at important centres and contributed sums towards the maintenance of an engine and other equipment by the local authority.

Agents were appointed in all the principal centres in Scotland and business rapidly expanded. So successful was the company that before the end of 1824 the North British Insurance Company made approaches to it with a view to amalgamation, an offer which was declined.

In May 1828 agencies were opened in the north of England at Newcastle, Carlisle, Alnwick and Whitehaven.

In 1833 the company applied for, and was granted, a Royal Charter.

In 1834 a branch was opened in London, and in 1837 a City branch office was opened in King William Street. The company continued to expand, becoming incorporated in 1847. In May 1878 it amalgamated with the Scottish National Insurance Company (founded 1841), when the title Scottish Union and National Insurance Company was adopted.

Emblem: The Scottish lion, said to have been adopted as a symbol of Scotland by King William the Lion (reigned 1165-1214), on whose seal it appears. The origin of the double tressure (inner border) is obscure, but it was certainly used on the Scottish arms before 1272.

The Saint Patrick Insurance Company of Ireland

DUBLIN 1824-c.1827

The capital was £2 million in 20,000 shares of £100 each. This was the largest of any insurance company established in Ireland to that date.

Read more...

The business of life, fire and marine insurance started on 1 June and seems to have expanded rapidly. The company had problems keeping accounts and collecting premiums, the company had difficulty in raising its capital, and, according to a shareholder of the Patriotic Assurance Company speaking at a meeting of that company in January 1827, 'the Saint Patrick had met with more fraudulent risks in Dublin than in any other place'.

Newspaper reports in 1827 indicate repeated attempts to have instalments of capital paid up, since there were 'a vast number of the Proprietory; including some of the most wealthy and ostensible persons connected with the establishment who had not paid up their instalments, there being claims upon the Company far beyond the amount of their funds.’

The company office at 35 College Green was taken over by the agents to the Alliance, British and Foreign Fire and Life Insurance Company in June 1827 and the company is generally considered to have ceased business about this time.

Emblem: St Patrick, patron saint of Ireland. He was born in Britain during the fifth century A.D. but was taken as a slave to Ireland when he was 16. He returned to Britain but after being made a bishop and went back to Ireland to convert the people to Christianity.

The Patriotic Assurance Company of Ireland

DUBLIN 1824-1972

Knowing the state of affairs of the Saint Patrick Insurance Company in 1826, several proprietors of the Patriotic demanded an Extraordinary General Meeting 'to consider the propriety of giving up the present practice of insuring against the perils of the sea through the medium of Agents in England', and in September of the following year the directors confirmed that the business of the company now was confined only to Ireland and that the British business had been given up.

Read more...The Daily Express, Dublin, of 26 March 1880 saw Bernard H. O'Reilly, the then manager, advertising that 'the Patriotic is the only Irish Insurance Company whose business is restricted to Ireland', but in later years the company saw expansion overseas, particularly in Australia.

From 1906, the Patriotic was associated with the Sun Insurance Company, which had operated in Ireland since 1811 and which opened a Dublin office in 1883. By 1972 the Patriotic was Ireland's oldest insurance company and the only successful survivor of half a dozen native companies established in the early 1820s, which was a time of rapid commercial and industrial expansion in Britain but of serious depression in Ireland. The company ceased transacting new business and renewing insurances on 30 November 1972, when it passed to the Sun Alliance and London Insurance Group.

Emblem: Patriotism, represented by a female figure, comforts a widow and children. On her shield she bears the Irish national symbol of a shamrock.

The Irish Alliance Insurance Company

DUBLIN 1824-1826

According to Wilson's Directory, the company was established 'for insuring houses, goods etc. from fire, insuring lives and purchasing and granting annuities with the strictest secrecy observed in all life insurances, with a Capital of £500,000’.

Read more...The Irish Alliance required all shareholders to insure a sum with the company in proportion to the number of shares held, and it announced in Freeman's Journal of 29 April 1824 that this plan had 'been most strictly adhered to, and already TWO MILLIONS of insurances have been signed for by Persons of the highest respectability anxious to become Proprietors'.

The company was not a success, and, despite a meeting in June 1826 of the Independent and Untrammelled Proprietors who have a regard for their interests and property', it passed that year to the National Assurance Company of Ireland.

The company used no emblem on its fire mark, which is notable for being the only one which incorporated a company's full address.

The Shamrock Assurance Company of Ireland

DUBLIN 1824-c.1829

In the Dublin Evening Post of 15 June 1824 the directors announced that for both life and fire insurance they would charge the lowest rates which have yet been offered by any similar establishment in the Empire.

Read more...The company appears to have been satisfied with a modest rate of progress in its first year and advertised in the Dublin Evening Post of 7 October 1824: “Indeed the terms are now so moderate as to place the benefit in every case within the reach of the humblest householder.”

The company is generally regarded as having existed for about five years before being wound up.

Emblem: A shamrock, regarded as a national and holy symbol of Ireland. It was used by Ireland's patron saint, St Patrick, to demonstrate the holy trinity.

Aberdeen Fire and Life Insurance Company

ABERDEEN 1825-1889

Established in January 1825, with a capital of £l million, the company was not registered until early in 1826. Its head office was at 89 Union Street and later a London office was opened at 36 Essex Street.

Read more...Two fire engines were maintained, one at the Flour Mill in St Nicholas Street and the other at the Water Reservoir in Broad Street. The company retained thirty-six firemen in constant pay, and the directors earnestly recommended that notice be sent to the 'Company's House' upon the first appearance of fire.

By 1836 nearly 5,000 policies had been issued, and at that date the secretary and manager was John Clerk. The Aberdeen's business continued to expand, and in 1852 it became incorporated and changed its name to the Scottish Provincial Insurance Company. At that time it had eighteen agents in various parts of Scotland.

In 1889 the company was taken over by the North British and Mercantile Insurance Company.

Emblem. The arms of Aberdeen which appear on seals of1430. The three triple towers are said to refer to the three fortified hills - Castle, Port and St Catherine's - on which the city had its origins.

The Northern Assurance Company

ABERDEEN 1836-1968

This company started life in Aberdeen, under the name of the North of Scotland Fire and Life Assurance Company.

In the mid 1830s over forty insurance companies had agencies in Aberdeen, and Sir Alexander Anderson, the founder of the North of Scotland, felt strongly that they were “drawing to a distance much money which might well be kept at home”.

Read more...In 1837 a fire engine was purchased and thirteen firemen and an engineer were engaged. Despite the setback of a broken main axle on its very first call, this did much good work until 1862, when it was handed over to the local authority's control. The company meanwhile had been renamed the Northern Assurance Company, following the Joint Stock Companies Registration Act of 1848.

From this time forward the business, which had already reached London, Edinburgh and Glasgow, expanded rapidly to the Continent of Europe and on throughout the world.

With this growth in the company's business, it soon became apparent that Aberdeen was no longer a suitable venue for its head office. The London branch was therefore elevated to this status and boards of directors in both Aberdeen and London formed a 'General Court of Directors' which administered the company.

After 132 years as a successful company, the Northern merged with the Commercial Union Assurance Company in 1968.

Emblem. The Scottish lion, said to have been adopted as a symbol of Scotland by King William the Lion (reigned 1165-1214), on whose seal it appears.

The North British and Mercantile Insurance Company

The North British and Mercantile Insurance Company was a British-based company founded in 1809 in Edinburgh and absorbed as a subsidiary of Commercial Union in 1959. The company was also known as the North British Insurance Company, North British Fire Office and North British Fire Insurance Company.

The Scottish Commercial Fire and Life Insurance Company

GLASGOW 1865-1880

The company was established in November 1865 with a subscribed capital of £514,250, of which £51,425 was paid up. In the first year the total of fire premiums received amounted to £17,353, and in 1867 it was decided to start a life assurance branch.

Read more...For the first six years the directors took no fees, and no dividends were paid to shareholders, but after that the company was sufficiently profitable to pay the usual rates to investors. After fifteen years of business the company passed to the Lancashire Insurance Company in 1880.

Emblem. A female figure, probably representing Caledonia, holding a palm leaf symbolising victory and supreme excellence. At her feet is a cornucopia (horn of plenty).

l'he Etna Fire Insurance Company

DUBLIN 1866-1868

The company was formed 'for the purpose of extending the insurance against loss or damage by fire of Merchandize, Buildings, Farming stock, etc. throughout Ireland, Great Britain and the Colonies, and also the insurance of cargo against loss or damage by fire or water, upon all ships of every class or denomination and upon cargoes or merchandize therein, in all home or foreign ports.'

New London insurers

Words by Brian Wright. Insurance company fire mark images courtesy of the CII Archive

The Commercial Union Assurance

LONDON 1861-

The Tooley Street fire in Bermondsey in 1861, in which Thames-side warehouses were destroyed, caused insurance losses of over £2 million. The Sun, Royal Exchange, Imperial and Royal Insurance companies, which had agreed a tariff for mercantile risks, consequently raised their premiums for insurance of merchandise stored in the 'water-side' districts.

Read more...

Protests were made to the mercantile tariff companies about the high premiums, but no satisfactory compromise was reached. At a meeting of prominent merchants and brokers held on 5 August 1861, it was decided to form a new company with a capital of £2,500,000 to underwrite mercantile risks at 'fair' rates. The venture quickly got underway and on 28 September the Commercial Union Assurance was officially established as a joint-stock company.

The Commercial Union took much business from old-established companies insuring wharves and warehouses, and the rating introduced by the company undercut the whole range of the tariff system except over extreme risks.

There followed two years of struggle for supremacy in mercantile insurance, until an agreement was eventually reached in November 1863 between the Commercial Union, the tariff companies and the northern companies for an amended London mercantile tariff.

The company did well in the life and marine department, but the fire business suffered heavy losses. In 1865 the fire fund was so depleted that it had to be topped up with £25,000 from the reserve fund, and the company failed to pay a dividend that year. The fire business made erratic progress until the late 1880s, when it increased steadily.

Agencies and branches were established in the United Kingdom and worldwide and many smaller companies were taken over - among them the Hand in Hand Fire and Life Insurance Society and the Union Assurance Society - until the Commercial Union became one of the largest British insurance groups.

Emblem. A salamander, a mythical lizard-like creature which could not only live in fire but extinguish the flames.

The Alliance, British and

Foreign Fire and Life

Insurance Company

1824-1959

The foundation of the company was the outcome of a discussion between Sir Moses Montefiore and Nathan Rothschild, who wished to form an insurance company with a larger share capital and more influential board. The company was formed with a capital of £5 million with a board consisting of many highly successful businessmen and bankers, including Montefiore and Rothschild.

Read more...It was decided that fire and life insurance should be undertaken in Europe, the West Indies and India, and the first British agents were appointed. Business rapidly expanded with policy holders participating in the profits of the company until 1862, when this practice was discontinued in respect of fire policies.

A fire brigade was formed shortly after business started, and regular contributions of money and equipment were made to various towns and cities in both Britain and overseas, a fire engine being sent to Montreal in Canada in1826. The company brigade was involved with many notable London fires, including that in 1838 which destroyed the Royal Exchange.

A period of expansion lasted from 1847 to 1923. By 1868 the company was considered to be one of the most solid insurance institutions in the United Kingdom. The company continued to make steady progress, changing its name to the Alliance Assurance Company in 1905. In 1959 the Alliance amalgamated with the Sun Insurance Office, the combined company using the title of the Sun Alliance Insurance Company.

Emblem: A castle on a rock portraying strength and protection.

The Palladium Life and Fire Assurance Society

1824-1856

The prospectus of the society stated that: “The object had been to form a society which should combine the advantages of those previously established…and to superadd the paramount principle of taking science exclusively for its guide in that part of its operations which so peculiarly require it.”

Read more...The funds of the fire and life departments were to be kept separate and four-fifths of the profits from the fire business were periodically divided among the policyholders.

The fire insurance business was discontinued in 1829 and taken over by the Phoenix Assurance Company the following year, mainly through the efforts of Jenkin Jones, the secretary of the Phoenix. The society dropped the word 'Fire' from its title from 1829, and continued life assurance until it passed to the Eagle Fire and Life Insurance Company in 1856.

Emblem: Pallas Athene, a goddess often associated with insurance, since she was regarded as a protective deity. She was also associated with defensive war, hence her spear, and with impregnability since she carried Medusa's head on her shield.

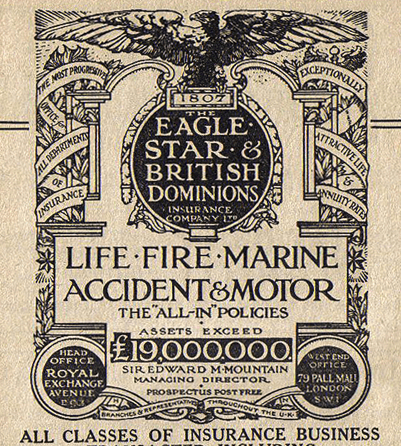

Eagle Star

1940 -

The Eagle Star Insurance Company was a leading British insurance business. It underwrote the full range of risks, including fire, accident, marine, motor, life, contingency and Pluvius (weather) insurance.

Read more...The Company was founded by Edward Mountain, a Lloyd’s broker in 1904 as a marine business known as the British Dominions Marine Insurance company. Within the first ten years, it had acquired the Eagle, the Sceptre and the Star. The acquisitions expanded its interests into general business, fire and motor insurance. It was renamed the Eagle Star & British Dominions in 1917 and Eagle Star in 1937.

Edward Mountain was knighted for his contribution to insurance in 1918, by which time the company had become the largest composite office in the UK.

In 1984 Eagle Star became part of B.A.T industries pls and saw diversification into financial services. In 1998 it became part of Zurich Financial Services Group.

The Aegis Fire and Life Insurance Company

LONDON 1825-1850

Founded with a proposed capital of £l million, the company had fire and life branches which appear to have operated distinctly. The dilapidation branch was part of the fire department and was the distinguishing feature of this company.

Read more...Little is known of the business history of the company and it passed to the English and Cambrian Life Insurance Company in 1850.

Emblem. The aegis (shield) of Athene - a protective deity often associated with fire insurance - bearing the head of Medusa. This had been fixed there by Athene after Medusa had been slain by Perseus, who had borrowed the shield. It represents impregnable defence and protection.

The Protector Fire Insurance Company

LONDON 1825-1835

The company maintained a fire brigade stationed near Southwark Bridge Road, in the charge of Edward Syer, and another near St Pancras New Church, Somers Town, north of London, in the charge of Jonathan Crookland.

Read more...

The Protector's rates of premium were set at 2s per cent for common insurance, 3s per cent for hazardous and 5s per cent for doubly hazardous. Losses by fire and lightning were made good, but the company would not be responsible for loss or damage by explosion.

Persons who took out policies for seven years in advance were charged premiums for only six years. In 1826 the Protector Life was set up to transact life assurance. It is probable that the profit-sharing scheme and fierce competition led to such greatly reduced profits that the directors decided to repay the capital to the shareholders and sell the insurance business for what they could get.

The License Victualleers Society

and General Fire

and Life Insurance Company

LONDON 1835-1857

The company began issuing policies in 1835, but the deed of settlement was not signed until 1 January 1836. The deed stated that the objects of the company were to insure houses, furniture, stock-in-trade, farming stock, shipping and 'every description of real and personal property (except books of account, deeds, notes, bills, bonds and written securities, stamps, tallies, money and gun powder), against loss by fire including losses by lightning'.

Read more...The capital of the company was £150,000 in 30,000 shares of £5 each, and it was stated that policies issued before the deed of settlement were still valid and would be honoured.

Little is known of the company's business history. In 1850 its name was changed to the Monarch Fire and Life Assurance Company, and in 1857 it passed to the Liverpool and London Fire and Life Insurance Company.

The General Life and Fire Assurance Company

COMING SOON

The Church of England

Life and Fire Assurance Trust

and Annuity Institution

COMING SOON

The Farmers and

General Fire and Life Insurance Institution

COMING SOON

The Star Life and Fire Assurance Society

LONDON 1843-1917

This company was established as the Star Life Assurance Society in 1843, about the same time that an earlier Star Life Assurance Company was officially wound up.

The company transacted only life business until 1845, when it began to underwrite fire insurance and the name was changed to the Star Life and Fire Assurance Society.

The fire department lasted only until 1853, and in that year the portfolio passed to the Manchester Fire Assurance Company, the Star then resuming the name of the Star Life Assurance Society. In 1917 the company amalgamated with the Eagle and British Dominions Insurance Company, and the combined group was known as the Eagle, Star and British Dominions Insurance Company.

Emblem. A star whose design is based on the Star of the Order of the Garter, the premier order of chivalry founded by Edward III in 1348. The star is made of chipped silver, gold and enamel.

The Anchor Fire and Life Insurance Company

LONDON 1849-1857

The company was founded with an authorised capital of £1 million in 50,000 shares of £20 each, of which upwards of £150,000 was subscribed. The company made its fire department an important part of its business, and extended its agencies throughout Britain and overseas. Local boards were established in Manchester, Glasgow and Hull.

Read more...The report of 1851 shows that in the first eighteen months the fire department had issued 3,800 policies insuring property to the value of £2,250,000 and producing a premium income of £7,109, with losses amounting to 16 per cent of premium income. By 1853 the premium income had risen to £12,000.

Despite this apparent progress, the affairs of the company were not in a satisfactory state. When Thomas Cave became managing director in 1855, he cut down the working expenses and made great efforts to place the business on a sound footing. This proved to be a slow process, and so the directors decided to amalgamate with the National Provincial Insurance Company but failed to do so owing to a technicality. The company then had to make a call of £1 per share to enable the business to continue.

In 1857 the Anchor amalgamated with the Bank of London Insurance Company.

Emblem. An anchor representing security.

The London and Lancashire Fire Insurance Company

LONDON AND LIVERPOOL 1861-1961

The first fire policy was issued to a Liverpool ironmonger on 25 March 1862, the London board not issuing its first policy until a few days later. The first claim met by the company was for 16s 6d paid out in August 1862 on a fire in a London haberdashery shop attributed to an unprotected gas light.

Read more...

The Liverpool office soon appointed agents in Manchester, Halifax and other centres, and the London board appointed agents in many southern towns. Before the end of 1862 agencies had been set up in Scotland and Ireland.

Most companies consolidated their home business before branching out overseas, but the London and Lancashire immediately undertook business in Australia, India, Canada and Jamaica, and acquired indirect interests in Europe by reinsurance agreements in France, Spain, Holland, Germany and Russia. Within a few months of starting, agents had been appointed successively in Paris, Hamburg, Bombay, Montreal, Melbourne, Stockholm and St Petersburg.

On 21 October 1862 the company became incorporated under the new Companies Act and then mounted a massive publicity campaign with bill posters in railway stations and the issue of fire marks and calendars.

The Liverpool office moved to Brown's Buildings near the Liverpool Exchange towards the end of 1862, and branches were set up in leading cities to reinforce the agency network.

The adverse national economic situation and losses abroad in 1866 caused problems, and the company was forced to borrow to the extent of half of its paid-up capital. However, it weathered the difficulties and became one of the country's most successful insurance companies.

In 1920 the company was renamed the London and Lancashire Insurance Company and in 1961 became allied with the Royal Insurance Company.

Emblem. Derived from the arms of the City of London and the Duchy of Lancaster.

The North British and Mercantile Insurance Company

EDINBURGH AND LONDON 1862-1959

The company was formed by the amalgamation of the North British Insurance Company and the Mercantile Insurance Company. The Mercantile was formed in 1861 after the Tooley Street fire, in which the large losses involved caused the established insurance companies to raise their premiums. The avowed aim of the directors of the company was to reduce the mercantile rates of the tariff companies. It soon became obvious that the directors of the North British had the same aim, and so negotiations took place which led to a merger of the two companies.

Read more...

Fire insurance business was pursued abroad with great energy, with the establishment of a New York agency. However, the American business, along with that of other insurance companies, suffered a setback when in 1871 the Chicago fire cost the company £325,000 and the following year the Boston fire resulted in a loss of £92,000. When the London board heard of the Chicago disaster, they cabled their New York agent to settle all losses promptly and subscribed $5,000 'for sufferers'. This offer received wide publicity in the United States and enhanced the company's prestige. In 1897 it formed an American company, the North British and Mercantile Company of New York, which was later renamed the Mercantile Insurance Company of America.

Towards the end of the nineteenth century, branches were established in Canada, Australia and India. In Europe the company conducted much business in Germany and Austria. In the United Kingdom it operated in Scotland, Ireland and South Wales, with agents in all the principal cities and towns of England. The company continued to grow, taking over various other companies to increase its range of insurance, entering the marine market in 1908 and underwriting accident insurance in 1910. It expanded worldwide through the first half of the twentieth century, but was experiencing difficulties, with losses in the United States and Canada.

In 1959 it was decided to become allied with the Commercial Union Assurance Company to enable both companies to consolidate and develop fire and casualty insurance in the United States.

Emblem. The first design is based on the arms of Edinburgh and London. The second design incorporates a guardian angel.

The Albert Fire Insurance Company

LONDON 1864-1866

Promoted by George Kirby, managing director of the Albert Life Insurance Company (founded 1838 and wound up 1869), the company had a capital of £l million and was established to transact fire and marine insurance.

Read more...

In an advertisement published in 1865 the company stated that it did not wish to associate itself with the Fire Offices' Committee, which had been formed in 1858, because 'every proposal for Fire Insurance will be treated strictly upon its own merits'. The rates and premium were Is 6d per cent for common insurance, 2 per cent for hazardous and 4s 6d per cent for doubly hazardous. The advertisement went on to state that losses caused by lightning and explosion of gas would be ‘recognised'.

Fire branches were established in Manchester, Bristol and Dublin, but after a promising start the company was taken over by the Western Fire Insurance Company in 1866.

Emblem. The head of Albert of Saxe-Coburg-Gotha (1819-61), Prince Consort to Queen Victoria.

The Britannia Fire Association

LONDON 1868-1879

Founded with a capital of £500,000 in 50,000 shares of £10, the company intended to conduct fire insurance of a select character, inclusive of the insurance of dwelling houses and shops, and of furniture and goods therein.

Read more...

Several directors of the Britannia were also members of the board of the British Medical and General Life Association, and the Britannia used the British Medical's agency network, so securing wide coverage in the United Kingdom from its first day of business. The Britannia, although à separate company, used the same premises and even staff to some extent.

Little is known of the business history of the company. In 1879 it was renamed the Britannia Home and Colonial Insurance Company but passed to the Anglo-French Fire Insurance Company the same year.

Emblem. Britannia, a patriotic figure representing Britain, who is usually depicted with a lion symbolising strength and security. It is not clear why Britannia is apparently standing on a platform composed of different types of fruit.

The Licenced Victuallers and

General Fire and Plate Glass

Insurance Company

LONDON 1875-1879

The company was established in October 1875 to transact plate glass insurance. In July 1876 the company announced that 'so extended has been the field of its operations ... the directors have decided to incorporate fire with plate-glass insurance’. There was a great demand for this from the victuallers insured with the company.

Read more...The company had a remarkably small working capital, a writer in an insurance journal describing it as a 'peculiar company'. The adding of fire insurance to the company's business was confirmed at a shareholders' meeting on 29 April 1876, and the word ‘Fire' was added to the title.

The avowed aims of the company were for 'the special interest of the licensed victualler, who has hitherto been subjected to exceptionally onerous and often unfair charges upon fire and plate glass insurance [since] their interest in respect of fire insurance, and the insurance of plate and other glasses, has not only been neglected, but they have all allowed it, for the want of mutual support, to be made an extra-hazardous risk by existing companies.'

The business of the company was not restricted to licensed victuallers but extended to other trades and private individuals. The company did not become very large and never seems to have been well organised. In early 1878 its name was changed to the Sceptre and Licensed Victuallers and General Fire Insurance Company. By July the company had simplified its name to the Sceptre Insurance Company and was wound up the following year, 1879.

Emblem. The head of Bacchus, son of Jupiter and Semele, who discovered the culture of the vine and how to extract its juice, is depicted with bunches of grapes and a wine barrel.

The National Fire Insurance Corporation

LONDON 1878-1888

The company transacted insurance only on private houses, chambers, offices and contents, and would not insure shops, warehouses, factories, mills or wharves. It would also cover outbuildings and stables and make good damage caused by lightning.

Read more...

The prospectus stated that "The losses through fires occurring in private houses are relatively small, and the promoters consider insurers of this class of property have hitherto contributed unduly to hazardous risks.'

The National offered lower rates of premium than other companies, stating that its premiums were one-third below the usual rate.

The company was the only one in Britain which confined itself to this 'safe' branch of risks, although the Phoenix Insurance Company of Frankfurt operated a similar scheme from about the 1870s and paid dividends of between 30 and 40 per cent to its shareholders. The National hoped for a similar return.

The company was not as successful as the promoters had hoped and after operating for ten years it passed to the Royal Insurance Company.

Emblem. The female figure probably represents Britannia.

The Lion Fire Insurance Company

LONDON 1879-1902

The company was established 'for carrying on the business of fire insurance in England and France... with power to open branches in other places ... and to extend the business to life, marine and accident insurance.”

Read more...

The company purchased business in the former French provinces of Alsace and Lorraine which had been ceded to the Germans after the Franco-Prussian war of 1870-71. French insurance companies in the area were forbidden to continue business on the grounds that they used their organisations for political purposes. Rather than let their business go to German companies, the French sold their portfolios to British ones.

Throughout its first year it expanded its business, establishing agencies in London and some other English centres and worldwide. Despite this, the company was not very profitable, and by 1900 was in difficulties.

Between 1894 and 1900 premium income amounted to £1,400,000, but during the same period £1,415,000 was paid out. In May 1901 the Dublin branch was closed and the business sold to the Yorkshire Fire and Life Insurance Company.

In December 1901, the Yorkshire offered to take over most of the Lion's remaining business since it wanted to expand. On 24 March 1902 the offer was accepted by the Lion shareholders as the company was facing collapse, the payment being partly in Yorkshire shares and partly in cash. The Yorkshire kept on the Lion staff at branch offices in Birmingham, Bristol, Glasgow, Leeds, Liverpool and Manchester.

An arrangement was reached with the North British and Mercantile agencies in Alsace-Lorraine whereby the Yorkshire would conduct new business in the name of the North British until it was granted its own concession, the Lion's concession having lapsed. The concession was finally granted by the German Chancellor in July 1903 after representations by the British Foreign Office.

The Lion was probably the last company to issue fire marks for use in Britain.

Emblem. The lion represents strength, security and alertness.

The Middlesex Fire Insurance Company

LONDON 1874-1877

Nothing is known about its business operated from 27 Moorgate Street and was wound up in 1877.

Read more...

Emblem. Based on the arms of Middlesex: threes seaxes, which were characteristic Saxon weapons. The was a single-edged hacking sword, with an angle sloping towards the point, representing a heraldic notched blade. These arms were attributed to the Saxon kingdom by the medieval heralds.

Return to start

Insurance development

The insurance sector continued to professionalise its processes and practices.

With shared data, some standardisation and a more informed understanding of risk management.

View slides

Insurance profession

With fire insurance academic Robin Pearson.

Competition, co-operation and professionalisation.

Formation of the CII

Professional organisatons began to form in the insurance sector, including the Institute of Actuaries in 1848 (focused more on life insurance) and later the Insurance Institute which was established in Manchester in March 1873. This later became known as the Chartered Insurance Institute (CII). Members were drawn from those with senior positions within the sector (mainly from the fire insurance offices).

It was set up as a place for the exchange of knowledge and ideas, with a particular focus on fire insurance, given the large number of textile manufacturers in the region.

The second local institute was founded in Glasgow in 1881, which held education as its main focus. This was soon followed by others, including Dublin 1885, Norwich 1886, Birmingham 1887 and Yorkshire 1888.

There was a growing interest in the idea of a central institution and in 1897 the institutes came together to form the Federation of Insurance Institutes of Great Britain and Ireland.

In 1912 the Chartered Insurance Institute was incorporated by Royal Charter.

Increasing specialisation and professionalisation of the sector.Professor Robin Pearson, author and insurance expert.

Women in insurance

As business boomed in the second half of the 19th century, a workforce was needed to carry out increasing volumes of paperwork. In particular, they needed someone to copy policies for clients and for filing.

This was detailed, repetitive work which needed focus and attention, as it was crucial to keep accurate records. Women were seen as ideal for filling this role, as it was widely assumed that women were temperamentally better suited to undertake routine, repetitive tasks – and they were cheaper. A Liverpool clerk’s journal in 1888 stated: “such work as copying out policies, which could be done almost if not quite as well by girls as by men…at a considerable reduction of costs”.

The women employed for these roles were well educated and from middle class backgrounds.

Figures from the Integrated Census Microdata database (extrapolated from the censuses 1851- 1911 of England and Wales) show:

1851 census shows 75 women insurance agents and 16 insurance officials/clerks

1861 census shows 167 women insurance agents and 36 insurance officials/clerks

1881 census shows 435 women insurance agents and 132 insurance officials/clerks

1891 census shows 413 women insurance agents and 247 insurance officials/clerks

1901 census shows 960 women insurance agents and 768 insurance officials/clerks

1911 census shows 1,994 women insurance agents and 889 insurance officials/clerks

Scottish General Fire Assurance Corporation employed Aviva’s first known female member of staff when M Louisa Shelton was appointed as a clerk in July 1895. Her salary was £26 pa – the equivalent of £18,670 today.

1896 Metropolitan Life Insurance Co.

Courtesy of the MetLife Archives

Goad's fire maps

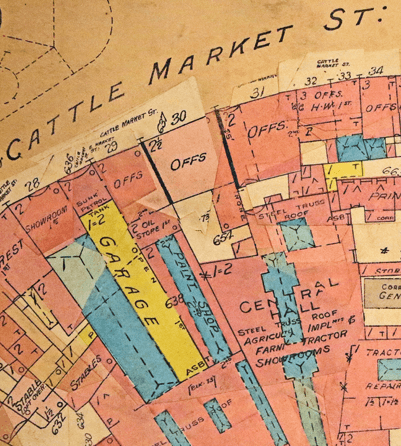

Goad maps or plans, are detailed street maps that include information on individual buildings, as well as their uses. To this day, they are used as a useful resource for town planners and developers, as well as by historians, though they were initially created for insurance purposes. Charles E Goad, a Civil Engineer, initially produced the maps via by his London-based firm Charles E. Goad Ltd. and they date back to 1885.

The maps were commissioned to provide insurance firms with vital information for assessing fire risk. This included building footprints, their use (commercial, residential, educational, etc.), the number of floors and the height of the building, as well as construction materials (and thus risk of burning) and special fire hazards (chemicals, kilns, ovens). Sometimes names and addresses are recorded. All this information helped with more accurate risk assessment and estimation of premiums.

Goad plans were made for the most important towns and cities of the British Isles at the scales of 1:480 (1 inch to 40 feet), as well as many foreign towns at 1:600 (1 inch to 50 feet).’

Goad fire map, courtesy of Brian Sharp's collection.

Photograph by Brian Henham.

Marketing innovation

Insurance companies continued to lead the way in marketing and began to use branded merchandise to promote themselves, as some of these examples from the Aviva Archives show.

Hand in Hand promotional match holder, c 1896

Ironically the Hand in Hand created a promotional metal match box to promote its fire and life insurance products.

Norwich Union Calendar, 1883

Promotional annual calendar for the Norwich Union Fire Insurance Society exclusively.

Norwich Union poster

Fire Society agency poster (Dewhirst, Aylsham) c 1892

Policy headers

Insurance companies continued to put a lot of emphasis on the design of their logos and policy headers. This header for North British & Mercantile was designed by the engraver Samuel Davenport 1783 - 1867.

Return to start

Global expansion

By the end of the 19th century, single risks were being redistributed right around the world through the technique of reinsurance

View slides

(Re)insurance

Agents and brokers initially expanded business overseas and then, from the 1820s used co-insurance and early forms of reinsurance to develop their business. Using superior knowledge and scientific and technical expertise they spread their risks geographically, making agreements with European and Russian insurers to reinsure property in the UK and Europe, and later the US.

During the 1830s and 1840s, British insurers moved into India, China and the Malay Peninsula and by the 1850s into Australia, New Zealand, South Africa, Asia, Latin America and the Middle East.

From the 1870s through to the first World War, there was a busy time of mergers and acquisitions, with UK insurers acquiring foreign companies and UK companies with an overseas operation.

By the end of the 1900s British market share in Europe declined as competition for business grew more fierce in that region. However, other parts of the world grew in importance including Canada, Australia and America.

Competition and co-operation and professionalisation.

Professor Robin Pearson, author and insurance expert.

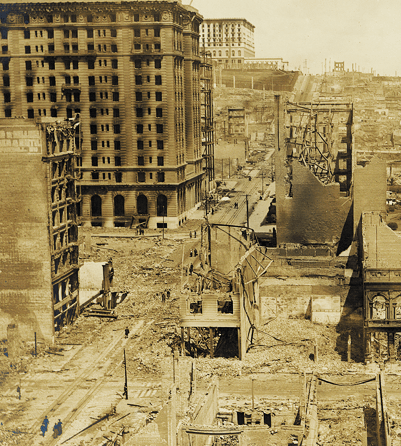

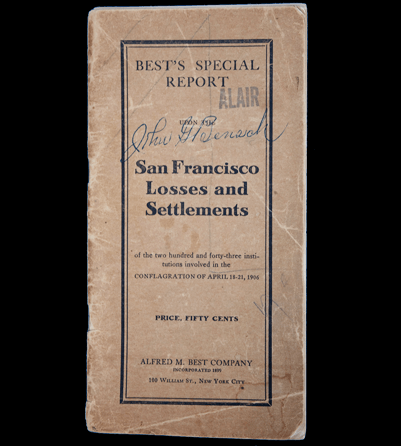

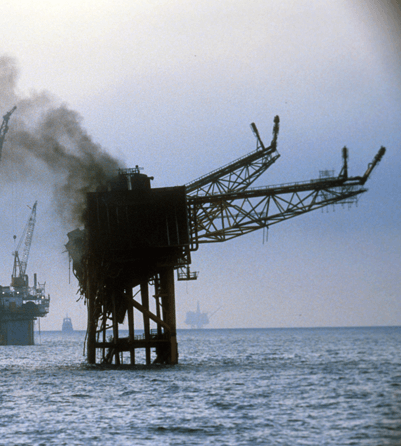

San Francisco fire

Estimates suggest that the US market accounted for 40% of British premium revenues between 1870 and 1914, but this left them vulnerable to significant claims.

In 1871 they suffered large losses from the Great fires of Chicago and Boston and then again in 1906 they suffered unprecedented losses as a result of the San Francisco earthquake. Damage from the earthquake amounted to USD 20 million and fire damage was estimated at USD 400 million.

It was one of the largest insured catastrophes of the 20th century and showed just how dependent the US insurance market was on British insurers and continental reinsurers.

Image of San Francisco after the earthquake and fires.

Pay all claims

Claims weren’t straightforward. Differences in insurance policies created confusion over whether policies should actually pay out for fire damage caused in the aftermath of the quake.

Despite the ambiguity, all 43 companies concerned paid out $235,000,000, an amount equal to the entire US insurance markets’ previous 47 years of profit. Many UK companies had to draw on home country resources to pay claims.

However, by paying out, they had demonstrated the value and growing relevance of reinsurance for spreading risk internationally.

In 1877, Cuthbert Heath a famous Lloyd’s underwriter ‘was approached by the Hand in Hand Insurance Company for the reinsurance of its fire policies; he made the bold decision to accept the risk. Over the following years, with Heath leading the way, Lloyd’s began to insure risks way beyond the traditional shipping ventures.’

‘At the time of the famous San Francisco earthquake, in 1906, Heath was a leading earthquake underwriter with Lloyd’s. His actions after the disaster cemented Lloyd’s reputation in the US. He insisted on paying all claims in relation to the earthquake and fires, and, in doing so, built the foundations of the modern Lloyd’s.’

Quote from Lloyd’s Corporation website.

Losses and Claims book produced by Best.

Courtesy Brian Henham.

Fire Office Committee (FOC)

Fire is one of the most expensive property insurance claims. An agreed fire policy came into being courtesy of the FOC in 1922, who encouraged a unifyied and consistent approach to fire risk across the insurance market.

It was Cuthbert Heath who developed a more comprehensive policy, designed to bridge the gap between traditional fire insurances and business interruption insurances. In so doing, Heath was told by the Chairman of the Fire Offices’ Committee that he was ‘ruining fire insurance’.

Following the FOC’s dissolution in 1985, the Association of British Insurers (ABI) took on the responsibility for the development of market-wide standard fire policy wordings, which evolved into a standard ‘all risks’ policy that the ABI issued in 1996.

Return to start

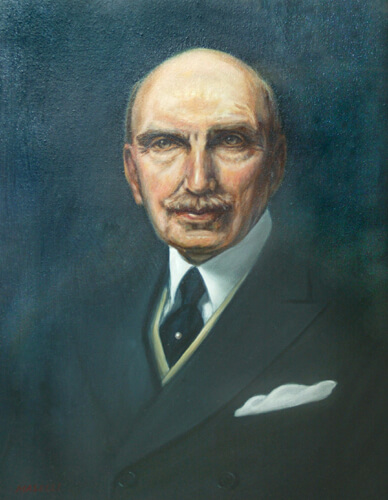

Painting of Cuthbert Heath, courtesy of the Insurance Hall of Fame

Fire insurance disappears

Composite insurance sold multiple insurance products within one insurance policy agreement, so instead of a single fire insurance policy. Insurance policies began to cover a mixture of possible risks such as flooding, theft, storm damage and included fire within this.

This signalled the end fire insurance as a single insurance product for fire offices.

View slides

Growth of general & composite insurance

British insurers in the 1800s specialised in one line of business, but by the end of the century, some were starting to offer a wider range of products, sometimes combining coverage such as fire and burglary, to create home insurance.

In particular, the larger insurers were keen to meet customer demand for a wider range of cover, such as personal accident, burglary and vehicle, by acquiring companies that specialised in them. This fostered a time in the early 1900s of mergers and acquisitions, when British insurers became bigger and more diverse, writing an increasing number of lines of business in the new form of composite insurance.

At the end of the 19th century, just a handful of UK insurers underwrote more than two lines of insurance. But over the next two decades the landscape changed. The number of pure fire insurers fell dramatically, until eventually fire insurance ceased to exist as an independent form of insurance.

As a result, the number of pure fire insurers fell dramatically during the first two decades of the 20th century. Some were absorbed by the growing composite insurers, others supplied the foundation for composites themselves. One of the largest composites, Commercial Union, acquired 21 companies between 1900 and 1939.

Commercial Union overseas fire agent sign.

Image courtesy Aviva Archive Group.

Expert view

With fire insurance academic Robin Pearson

Composite insurance with the Eagle Star

Eagle Star

Edward Mountain initially joined a Lloyd’s underwriting firm, in 1904 he acquired the marine insurance business of British Dominions Insurance and formed British Dominions Marine Insurance Company (in the five principal overseas Dominions). He then established a reputation for himself by refusing to insure the RMS Titanic on her maiden voyage. The company started writing fire and accident policies in 1911 and life assurance policies in 1916.

Within the first ten years, the company had expanded into general business, fire and motor insurance. In 1911 the name changed to British Dominions General. New departments were opened for accident and employers’ liability in 1914. In 1916 the company further expanded into life business. In May 1917 the company became Eagle and British Dominions to reflect the acquisition of Eagle Insurance Company (Fire and Life insurance company founded in 1807) in December 1916. In December 1917, following the merger with the Star, the name changed to Eagle, Star and British Dominions. In 1937 the company name was simplified to Eagle Star.

Edward Mountain was knighted for his contribution to insurance in 1918, by which time the company had become the largest composite offices in the United Kingdom. Advertising was a key component in the success of the company, mainly through the work of A F Shepherd, Publicity Manager. All-In policy (1915) and Victory War Loan (1917) were launched with high-level publicity campaigns. Between the First and Second World Wars further schemes included free newspaper insurance, Pluvius weather underwriting business, and an department specialising in women’s insurance needs. Expansion saw the development of a network of agencies and branches in United Kingdom and abroad, supported by local boards consisting of business and professional men from each region. After 1945 further extensions to the network were made alongside the establishment and acquisition of companies world-wide including specialist insurance companies such as Navigators and General, and Home and Overseas.

During 1916 and 1917 he acquired, in quick succession, the Eagle, Sceptre and Star Insurance Companies integrating them with his own business to create Eagle & British Dominions, which grew to become one of the largest insurance companies in the United Kingdom, ultimately Eagle Star Insurance.

For many years its Head Office was at the prestigious address 1 Threadneedle Street, London EC2. In 1981 it fought off a takeover bid from Allianz, the German insurance Group. It was acquired by BAT Industries for £968m in 1984. It continued to trade, under the Eagle Star name, until acquisition by Zurich Financial Services in 1999.

The Eagle Star leveraged advertising campaigns very successfully to build their business into one of the largest in the UK.

Expert view

With fire insurance academic Robin Pearson

The end of fire insurance

Return to start

End of an era

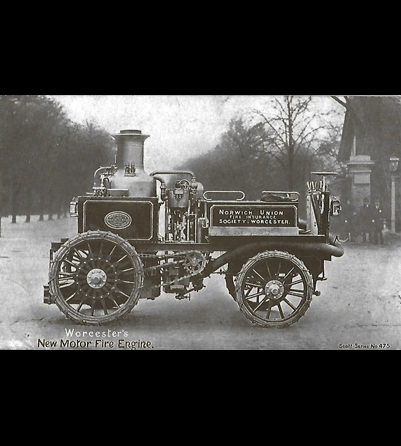

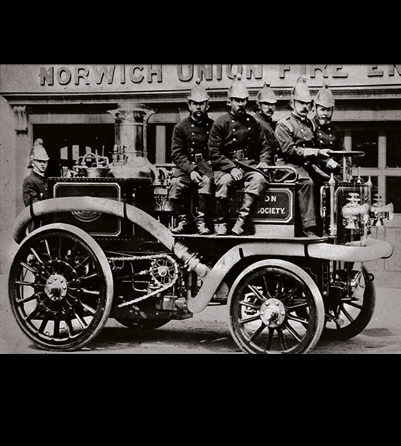

The insurance firefighting brigades provided the foundations for today’s firefighting services and were the only organised firefighting service available for most communities until the end of the 19th century. The last fire insurance brigade attendance at a fire was in 1929 in Worcester, almost 250 years since Dr Nicholas Barbon’s fire office and watermen firefighters were formed in 1680, 14 years after the Great Fire of London.

View slides

Firefighting in the provinces

There were no national requirements to provide fire engines or brigades in provincial cities, towns or villages, so not surprisingly outside London, firefighting remained largely uncoordinated. Levels of cover varied greatly from one area to another, in terms of types of brigade, equipment available and efficiency.

Some towns formed municipal brigades. For instance in Manchester, the town brigade was so efficient that by 1832 the insurance companies had withdrawn theirs. Other towns were reluctant to establish municipal brigades because of the additional cost, especially if they felt adequate protection was already provided by the insurance brigades or by local volunteer brigades. Between the 1840s and 1880s a large number of volunteer brigades were also established.

In rural areas, where the amount of insured property was too low to encourage an insurance company to set up a fire brigade, the gap was sometimes filled by private brigades such as those belonging to large country estates. Owners of industrial premises (for example, cotton mills) also set up their own works brigades, with insurance companies sometimes donating equipment.

Early model of the steam powered Merryweather Fire King fire engine.

Image courtesy Ron Long.

The final days of the insurance brigades

Throughout the 1870s and 1880s the insurance companies were becoming increasingly reluctant to maintain their own fire brigades or even contribute towards the running costs of municipal brigades.

The maintenance of an insurance company brigade was closely linked to the amount of business they had in the area, so if the amount of insured property fell too low, they would disband their brigade.