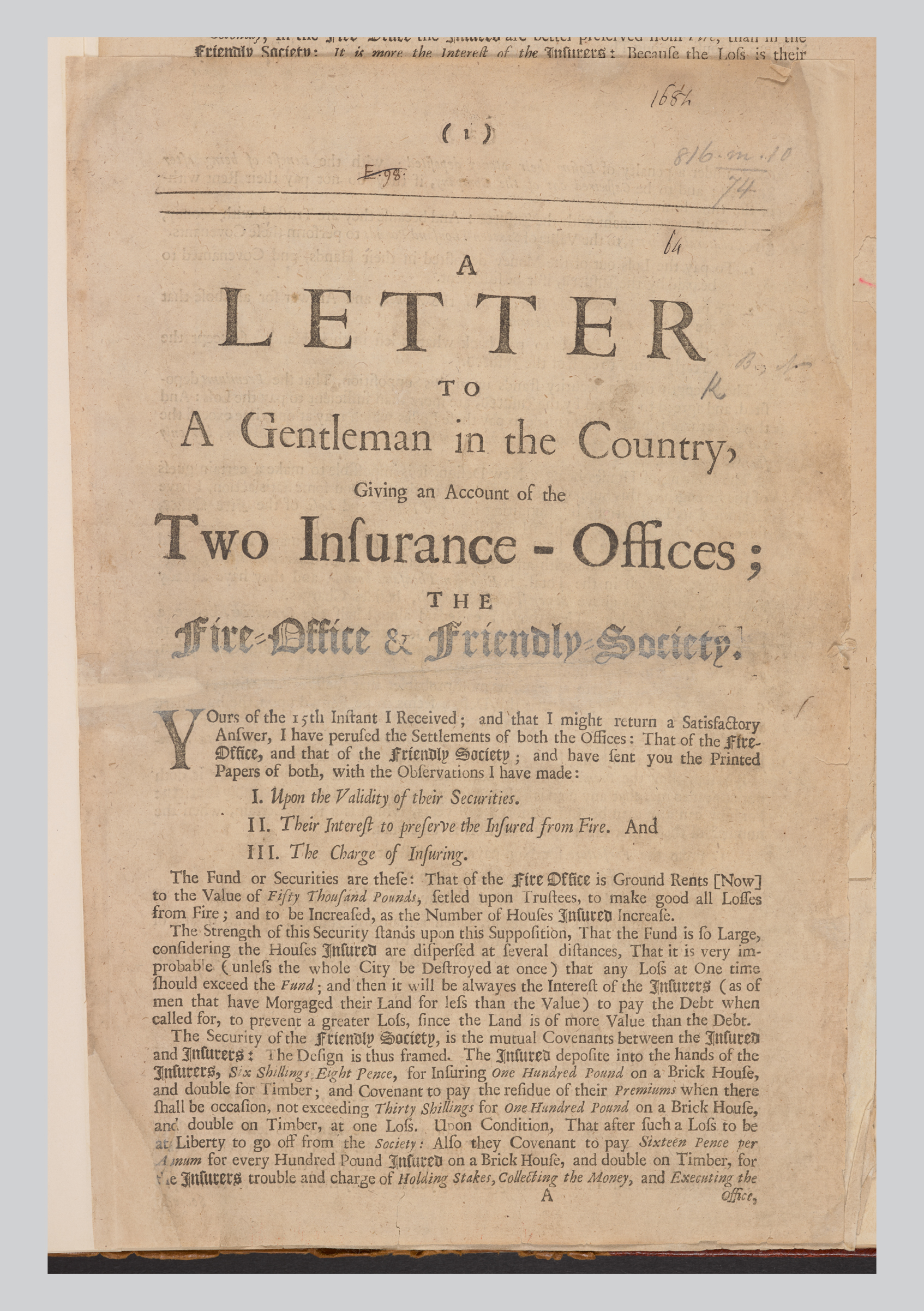

The Great Fire of London

2nd - 6th Sept. 1666

A massive fire swept through the City of London,

destroying everything in its path.

Eyewitness accounts provide a unique insight

into this catastrophic event.

View slides

Day one

Day two

Day three

Day four

Eyewitness accounts

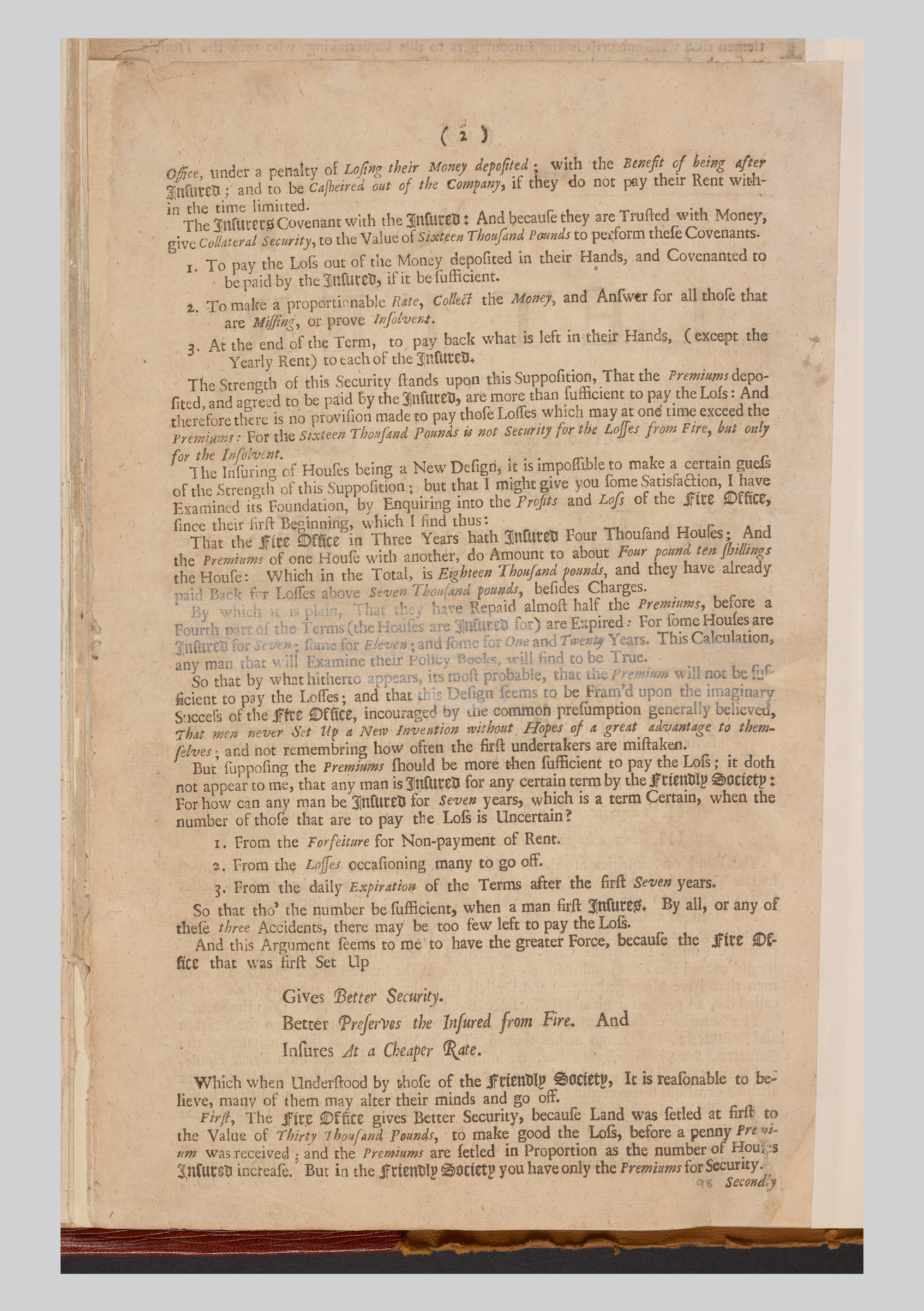

To explore more first-hand eyewitness accounts from the Great Fire of London, you could look up the following people.

Samuel Pepys

English naval administrator Samuel Pepys (1633-1703) wrote an eyewitness account of the great fire in a diary he kept from 1659 to 1669. In it he states that he saw:

“The fire continuing, after dinner I took coach with my wife and sonn; went to the Bank side in Southwark, where we beheld that dismal spectacle, the whole citty in dreadful flames near ye water side; all the houses from the Bridge, all Thames Street, and upwards towards Cheapeside, downe to the Three Cranes, were now consum’d”.

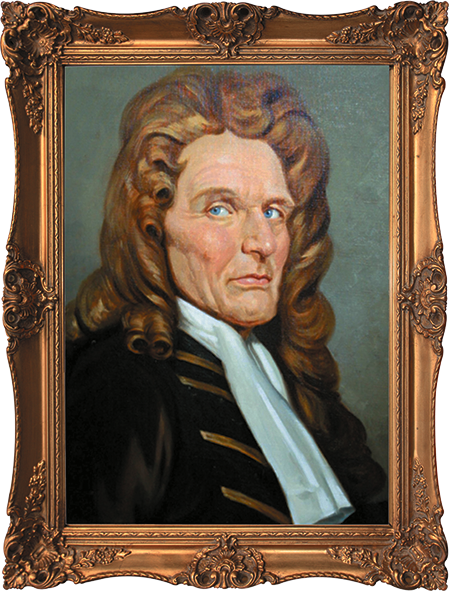

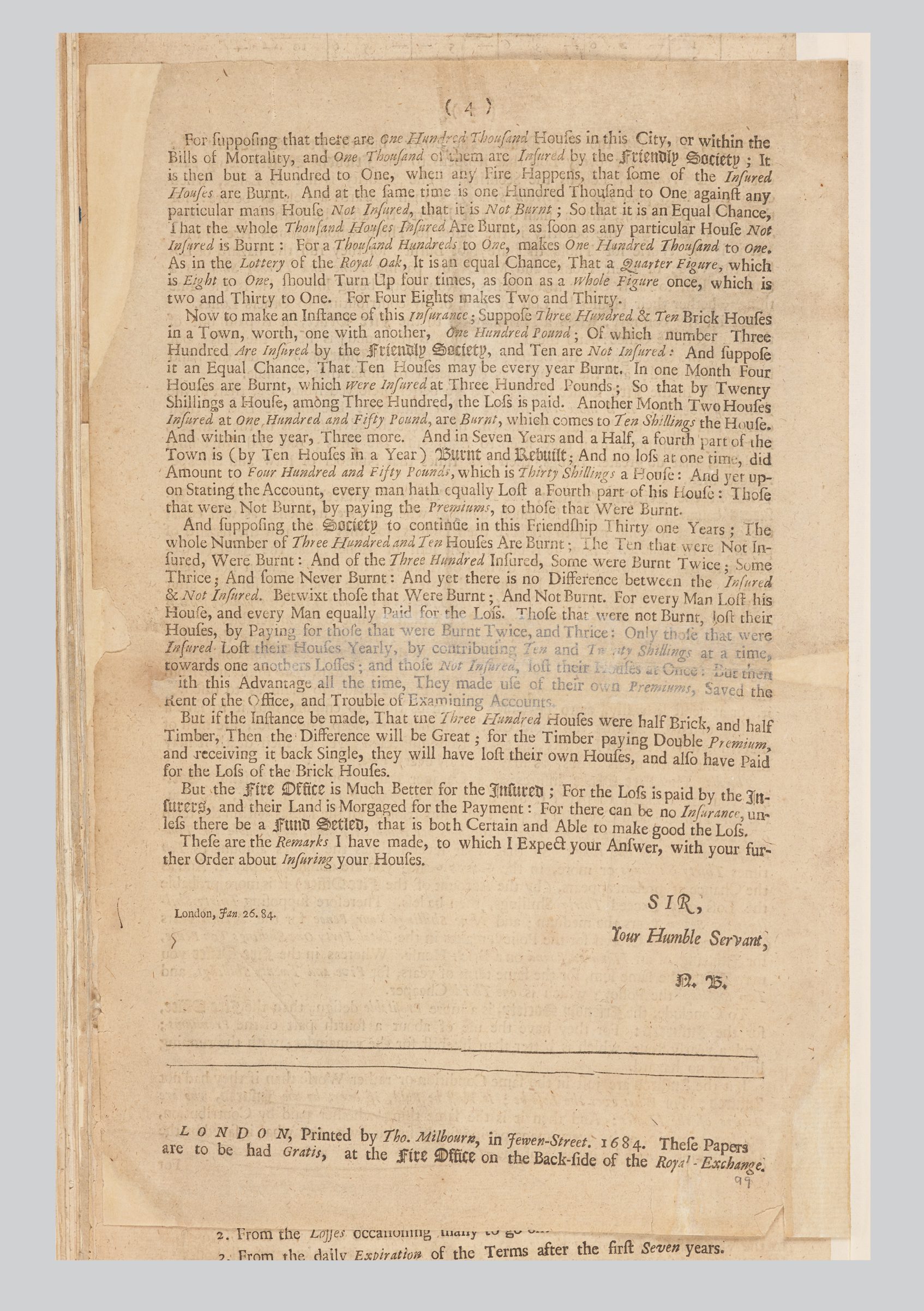

John Evelyn

Another contemporary eyewitness was John Evelyn (1620 – 1706) who wrote of the fire:

“Everybody endeavouring to remove their goods, and flinging into the river or bringing them into lighters that lay off; poor people staying in their houses as long as till the very fire touched them, and then running into boats, or clambering from one pair of stairs by the water-side to another”

Return to start