Dr Mary Reynolds OBE worked in the insurance sector for over 40 years. Although she was trained in medicine, not insurance, she went on to have a huge impact in the insurance profession. In the late 1960s Mary was first employed by Canada Life Assurance and stayed with them until the early 2000s. By the 1990s she was the Chief Medical Officer, and Chief Underwriter for Canada Life, and was the Chairman of ABI Medical Affairs Committee. I recently met Mary at her home in Caerleon, Wales. Although retired 20 years now, she has a very clear memories of her career and a wonderful overview of the insurance world from the 1960s to early 2000s.

On starting her job at Canada Life in 1967, Mary knew nothing about insurance. She had a medical training and had been practicing in a hospital. In her words, she “didn’t know an endowment from a term plan”. The logic behind her appointment was that she would work with the Chief Underwriter for two years and then take over from him. Mary’s immediate reportee was a capable and enthusiastic man, Geoff Church, from whom she learnt her underwriting skills. She moved him into her office and between them, they transformed the speed and quality of underwriting.

Mary had a team of over 50 women and young men administrators, and let them get on with the work using their expertise and knowledge. Early on in her role, she tried to “roll her sleeves up” and help out. A small number of policies were passed her way, but Mary had no idea what they meant, the jargon or content. She ended up returning them and filing all the policies in numerical order.

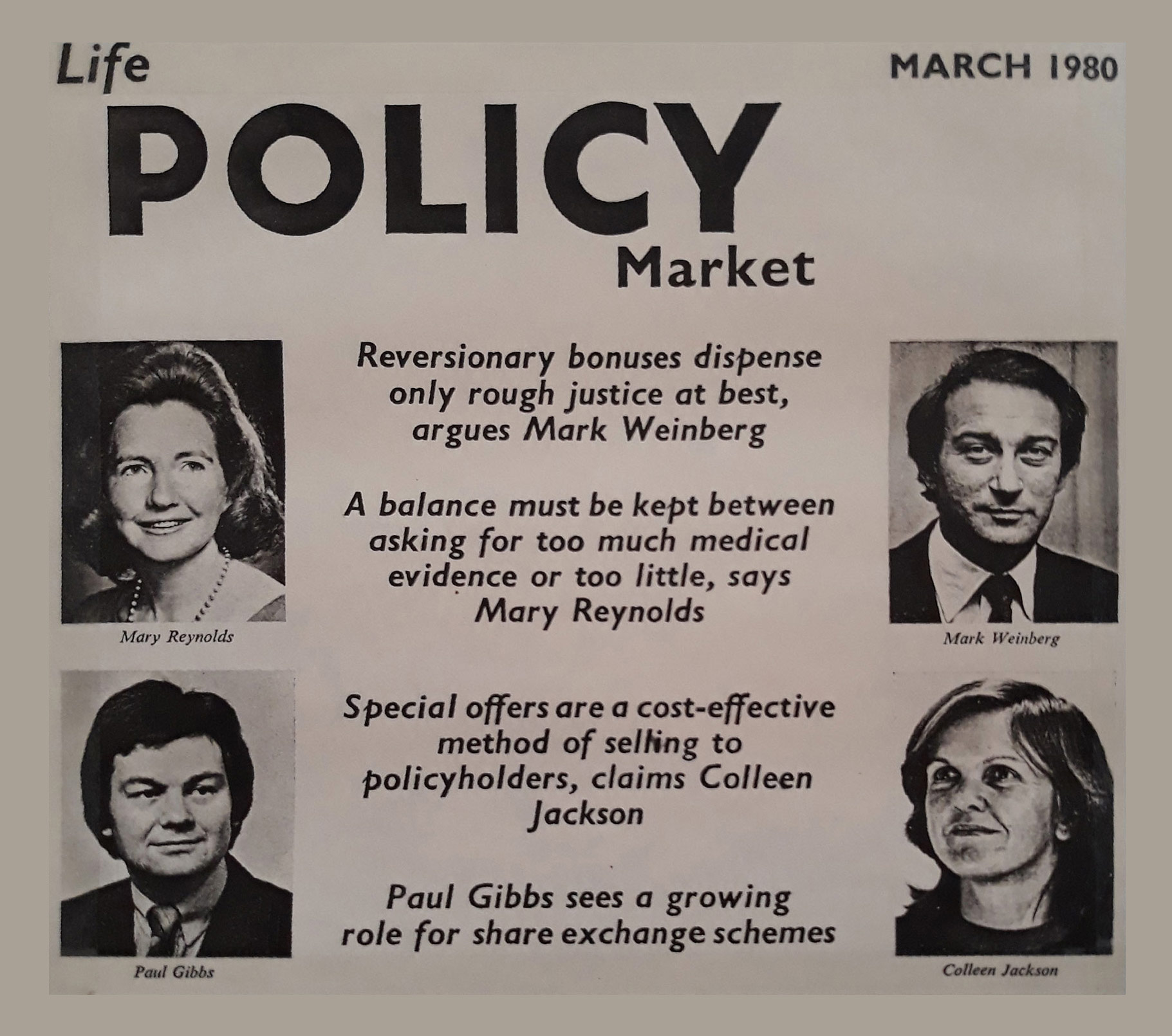

Being a woman in a male dominated environment Mary faced encouragement and resistance. Early on in her career, she was thrown into the limelight, and even firing line, representing the insurance sector. There was a claim in the media that the life insurance sector was robbing mothers and babies of their rightful due when their husbands died. The ABI (successor to the Life Offices’ Association and British Insurance Association, which merged) asked Mary to defend the insurance professions’ position in a very emotional situation. She was frustrated that the insurers did not get their approach and policies quite right and would challenge them. The ABI asked Mary to chair their Medical Committee, and in the early 1970s she represented the insurance profession on a serious TV panel debate chaired by David Dimbleby. She found the questioning tough, but stood her ground.

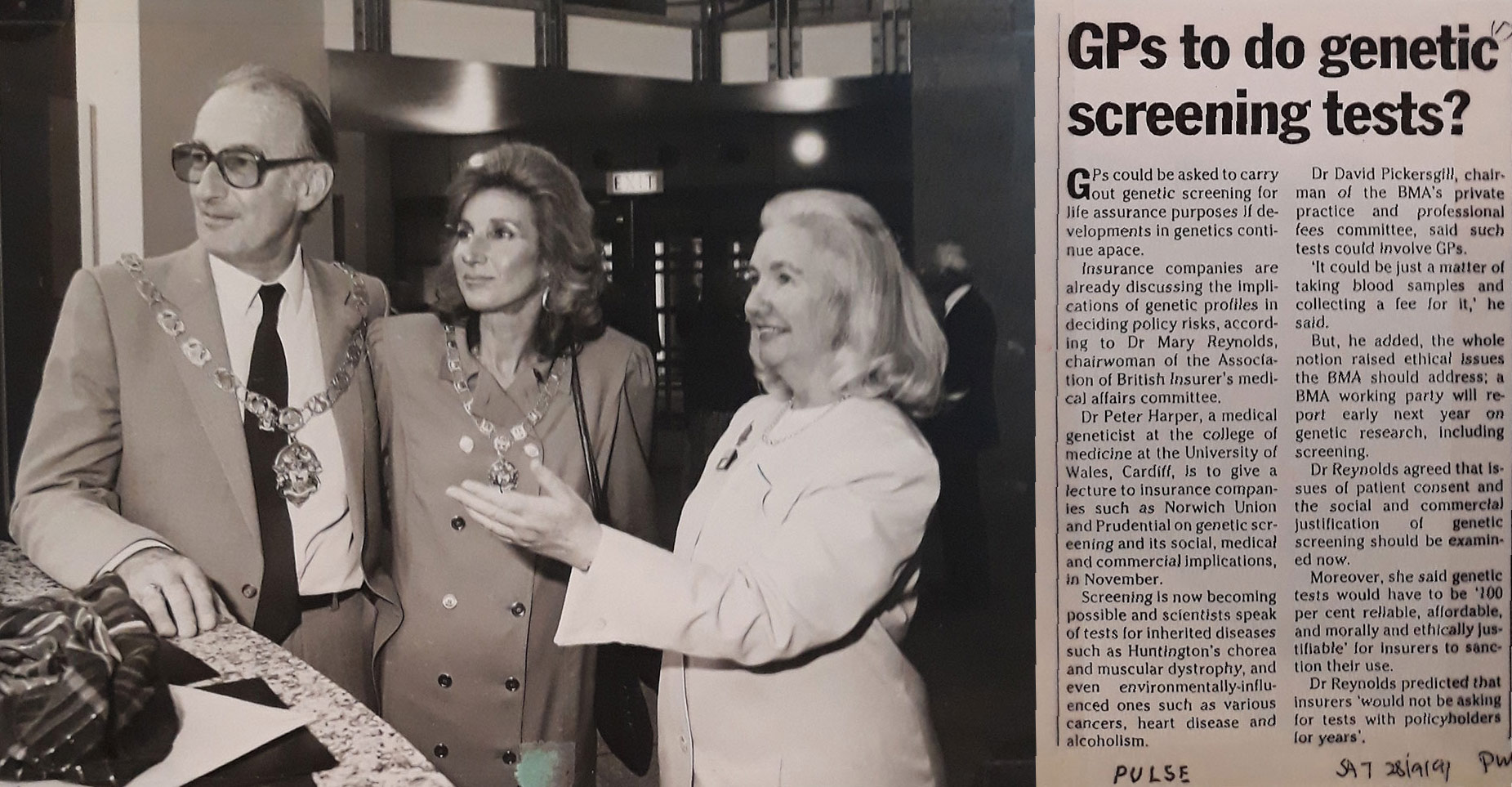

Representing the insurance sector was not an easy job. There were many emotive issues and challenging headlines when dealing with life insurance and people’s lives. By the mid-1980s AIDs had become an epidemic and many people, government and health agencies were worried. The Insurance companies approach to life insurance, the gay community and people with HIV or AIDS, was in the usual high risk/low risk mode with basic proxy question. This was cumbersome. Without any guidance on the issue, the initial response was increasing premiums, refusing cover, and making assumptions about lifestyles.

One question around taking a blood test caused a lot of problems. Blood tests were required for many insurance applications with risk factors. If the test was refused insurance cover might not be provided. Blood testing became a particularly difficult issue for HIV because many applicants did not want to be tested, because of the stigma attached to it. The blood test question was seen as prejudicial and made assumptions about people’s lifestyles. Additionally, there were many people who took HIV blood tests for work related reasons and were not part of the gay community. It also flew in the face of government public health policy, which wanted to see testing extended.

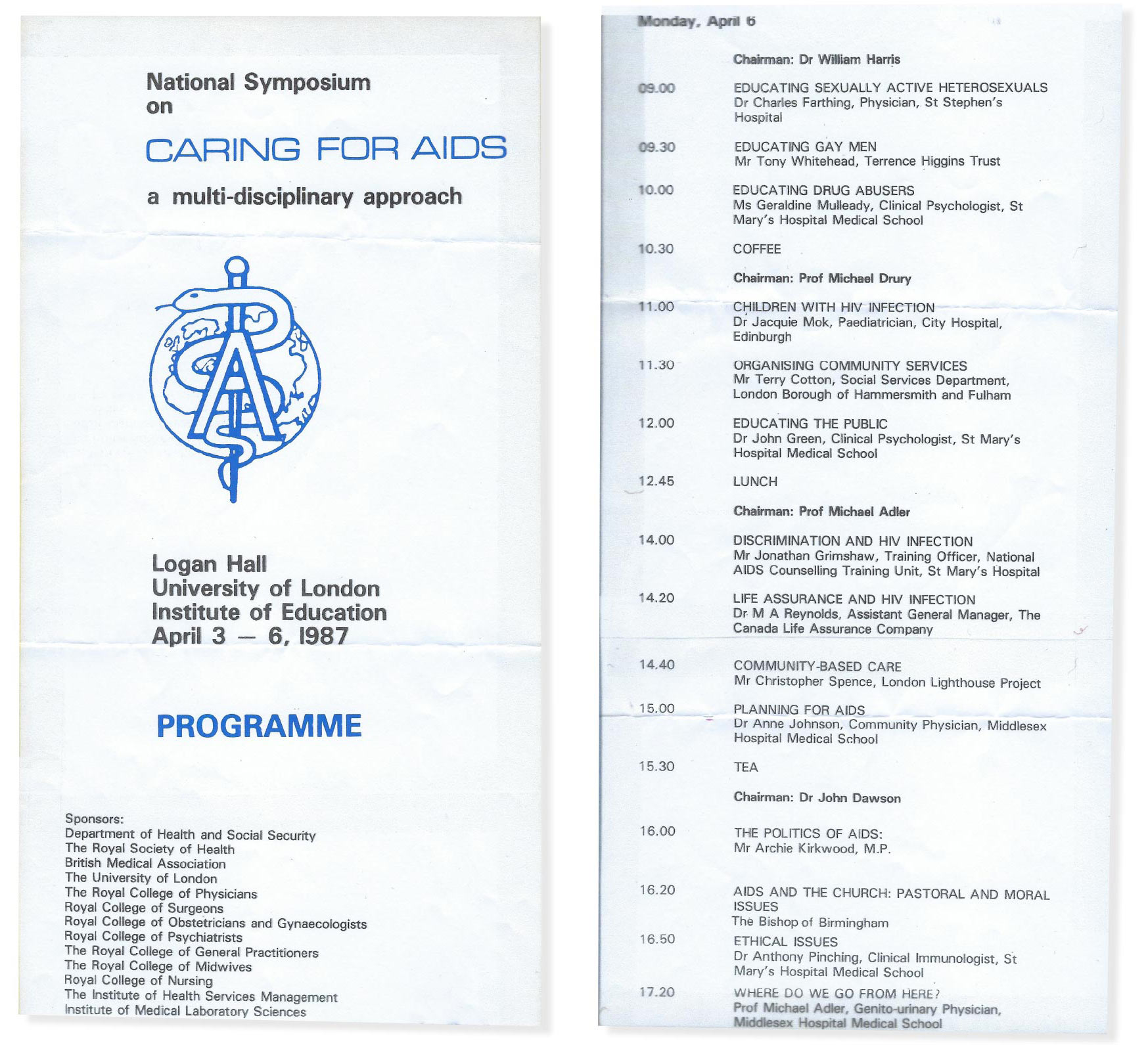

Mary represented the insurance profession at a major conference, Caring for AIDS, in 1987. It was a wide-reaching conference with social services, the medical profession, charities such as the Higgins Trust and Lighthouse, and individuals affected by AIDs. People were upset about not being able to get insurance and the audience was potentially hostile. Mary said she was anxious about the conference, as it was again, dealing with people’s lives and highly emotive. There would be a lot of campaigners there, as well as people who had AIDS. She presented the data and the reasons for the decisions the insurance sector took. Everyone listened quietly and took on board what Mary said, to her relief.

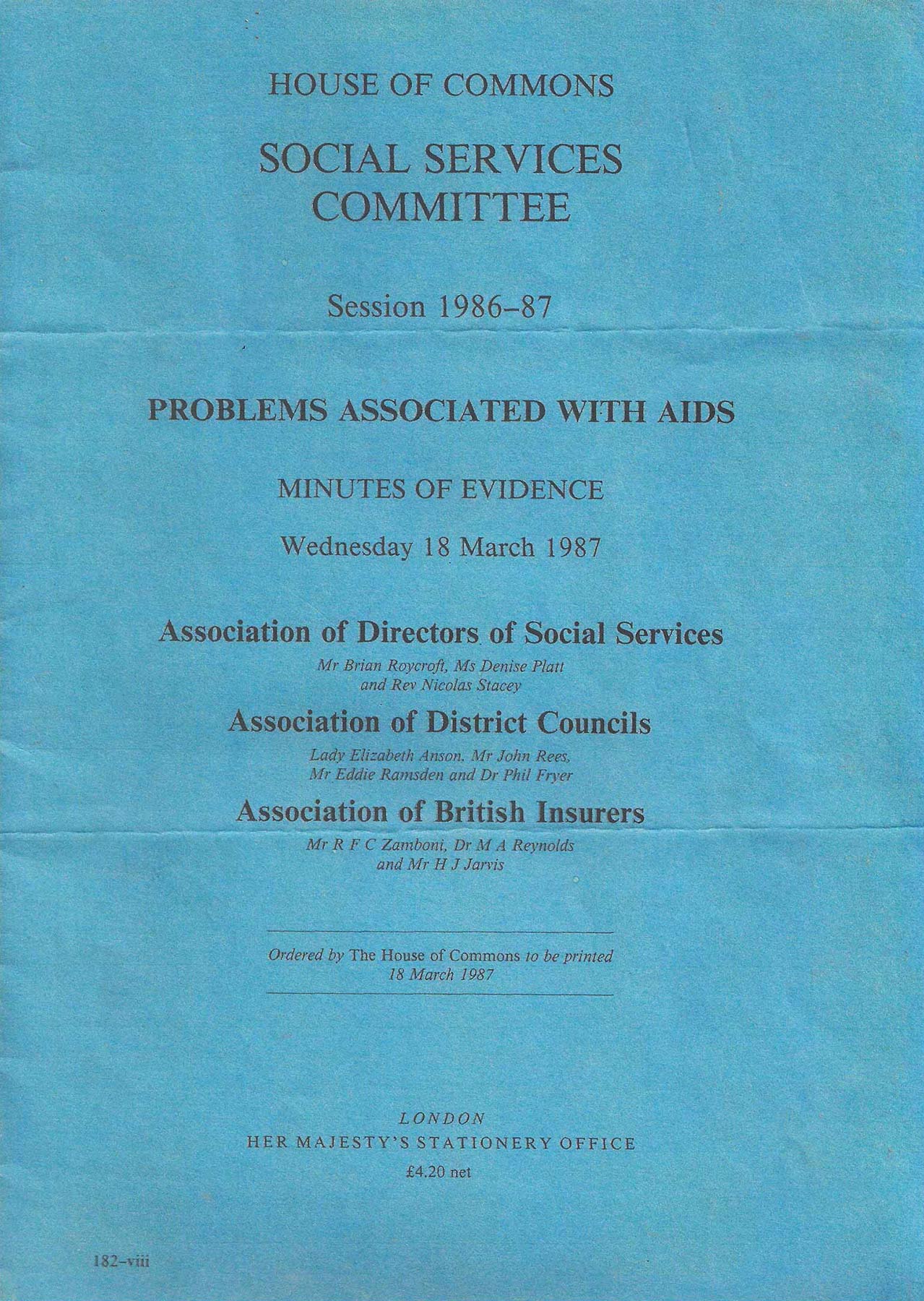

Mary also presented to the House of Commons Social Services Select Committee, on the Problems Associated with AIDS, 1986-87, Whilst representing the insurance profession, at the same time she promoted non-reactionary and pragmatic approaches to the gay community. In her words, she always “balanced both parties and tried to be fair.”

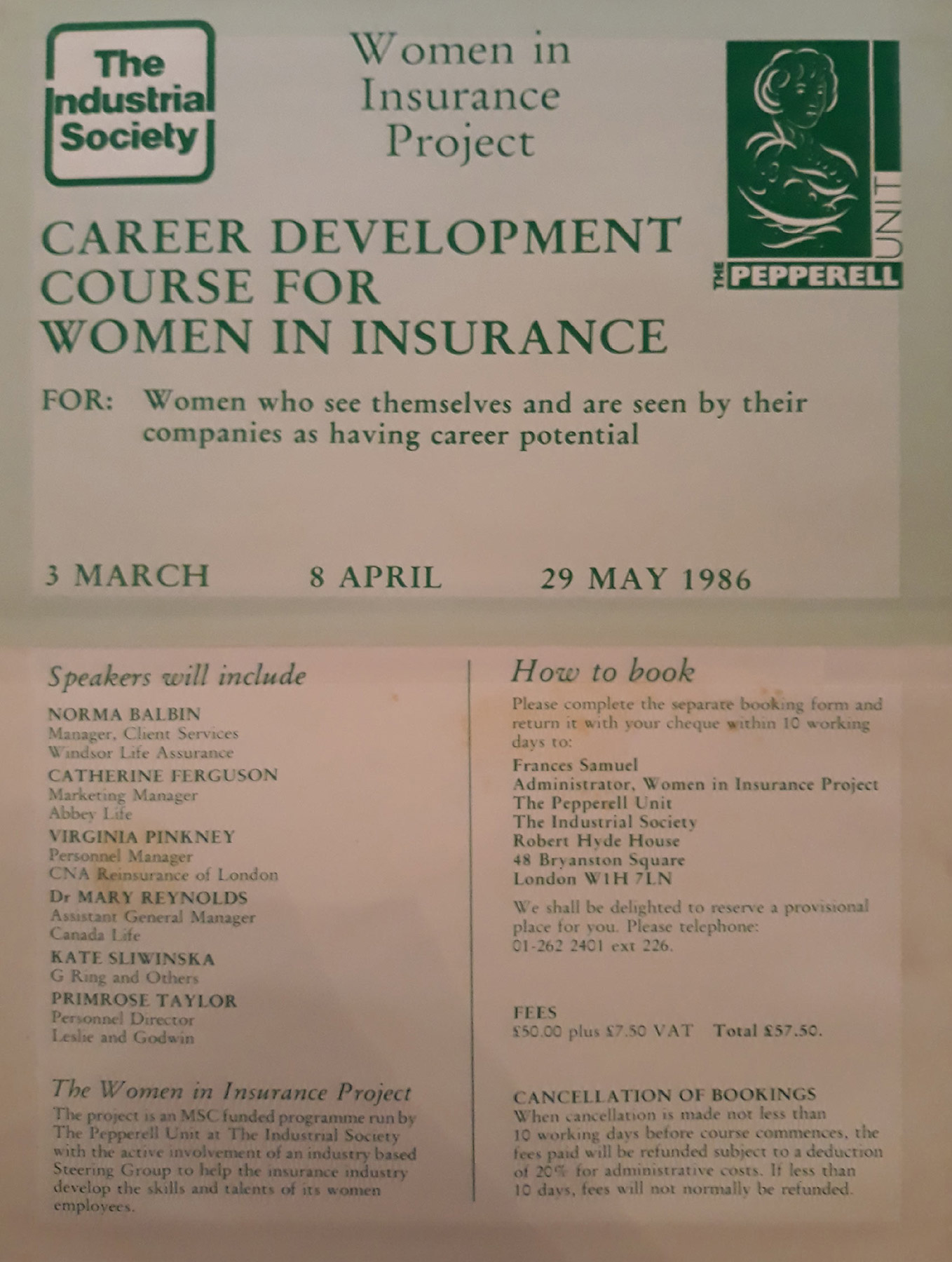

When it came to careers, Mary is very egalitarian, with a strong belief in the “best for the job.” She presented for the Women in Insurance Project in 1986, which supported women in their careers. This is at a time when only a handful of women were working at senior levels in insurance, and most were still working in administration. She very much believed in a holistic view of improving organisational culture, attitudes and perceptions.

The two things Mary is proud of are changing attitudes and underwriting policy on female sickness insurance, where she got the extra female premium of 50% removed, and being part of the drive to get women into the board room. Mary was on many boards and committees. In addition to chairing the ABI’s medical affairs Committee, she chaired the Benevolent Fund and Orphans’ Fund committees (now the Insurance Charities) and was the first female President of the Assurance Medical Society in 100 years. Working with the British Medical Association and the ABI she improved and standardised the medical profession’s understanding and practice of medical insurance. Mary also aimed to improve the standard of underwriting and the image of the insurance industry. Her OBE was for services to the insurance industry.

When I met her, we discussed her career with many delightful anecdotes. She is someone who talks about the positive side of her career. We went through some of her archive, which consists of newspaper articles, conference programmes she lectured at, papers she presented and published, as well as papers for government select committees. I had barely skimmed the surface but managed to get a few photographs of documents. This collection represents Mary’s career, achievements and her life, not of an organisation or business archive. It is quite unique and sheds some historical light on the Medical Insurance Industry at that time.

Mary represented the medical and life assurance sector/profession at a time when it was not so linked up with general insurance. She said being a doctor helped her being accepted in her roles. She made decisions, worked from a point that was based on her knowledge and skills. She is a modest person, and in our conversation, she did not get into the detail of her work. That would have been a very much in depth and detailed discussion.

Mary has left me with a lot more questions to answer than I had before I met her. The Insurance Museum is hoping to work a bit more with her recording her career and will also look to do so with other insurers who worked over the past 5 decades.