The Story of Road Transport & General Insurance Company Ltd

Despite sending a sizeable number of insurance-related items of ephemera or “junk” as my long-suffering wife preferred to describe it, onto the Insurance Museum for their collection a few years ago, I have still kept a few interesting pieces.

These include an edition of Lloyd’s List dating to 1982, a Prudential Assurance premium receipt book for a policy surrendered many years ago and a Cornhill Insurance wall plaque.

Also, I have this rather charming item in my collection. It is a small desktop perpetual calendar incorporating a thermometer, most likely handed to a customer or, most likely, an agent of the Road Transport & General Insurance Company Limited by one of their sales representatives. The purpose of this gift may have been to express appreciation for placing business with their company, to serve as a reminder to use the Road Transport & General when looking to place a client’s business or simply for advertising purposes.

Photo Credit: T Lane

Due to my keen interest in insurance-related topics, this small object, which measures approximately 4.5 by 4.5 inches and is made from moulded plastic and cardboard, raises a few questions I have never previously considered during its time in my custodianship.

To someone who has 45+ years of experience in the profession, working in many roles including agency development, possibly the most obvious question is, “What was the Road Transport & General Insurance Company?” Despite my advancing years and consequent experience, this is an insurer whom I had never encountered.

A little research reveals that Road Transport & General has an interesting history worthy of further exploration. The business was established in December 1918 by Thomas Tilling Ltd, one of two conglomerates that controlled the major bus operators throughout the UK between World War I and World War II.

Thomas Tilling Ltd. was founded by 21-year-old Thomas Tilling in 1846. He launched his business as a “job master” or keeper of a livery stable, renting out horses and carriages by the week or month. By early 1850, he had purchased a “horse bus” and the right to operate four daily routes between Peckham and Oxford Street in London.

Thomas’s business thrived, and by 1856, he had a stable of 70 horses. For those having an interest in both the history of fire brigades and the development of fire insurance in the UK, Thomas was contracted by the Metropolitan Fire Brigade in 1866 to supply and train horses for use in hauling fire engines. His business continued to do well, and by the time of his death in 1893, he was the largest supplier of horses and vehicles in London, owning over 4,000 horses.

By 1918, the business founded by Thomas was controlled by two of his sons and a son-in-law who had formed the limited company, Thomas Tilling Ltd in 1897.

Since the formation of the business, a considerable sum had been spent on insurance of various kinds. During a meeting of the then directors in December 1918, and after careful consideration of their results, it was decided to form a small private company for insurance purposes. It should be remembered that at the time, an insurance company could be launched with little capital, no background checks on individuals starting the company and no requirement for prior experience in the insurance profession.

Although the primary purpose of this new insurer was to take over the major portion of the Thomas Tilling insurance business handled by other insurance companies, it was not intended that its activities were restricted to covering only the transport business.

Therefore, on the 1st of January 1919, Road Transport & General Insurance Company Limited began trading at Winchester House, Peckham, London. Initially, it provided transit insurance for the Thomas Tilling Ltd transport activities and additionally, to directors, friends, and shareholders of the business.

In 1920, the office relocated to 20 Victoria Street, London, where it remained until 1931.

This period in the business’s history occurred when another much larger insurer, General Accident Fire & Life Assurance Corporation Ltd, formed in Perth, Scotland in 1885, and a pioneer of motor insurance, was undertaking a substantial period of post-World War I growth. So much so, in 1923, Road Transport and General Insurance Company became a subsidiary of General Accident.

Between 1919 and 1930, the business was managed by Mr. John Frederick Heaton, who played a key role in expanding it, particularly by developing into the broader general market. By the time he departed the business, it was offering a range of policies including fire, motor, workman’s compensation, sickness and accident, goods in transit, horse driving accidents, burglary, third party, property owners’ indemnity, loss of profits, plate glass, guarantee, householders’ comprehensive, traders’ comprehensive and boiler insurance. Advertising signs of the time suggest a more modest offering of “Fire, Accident, Motor, Etc, Etc.”

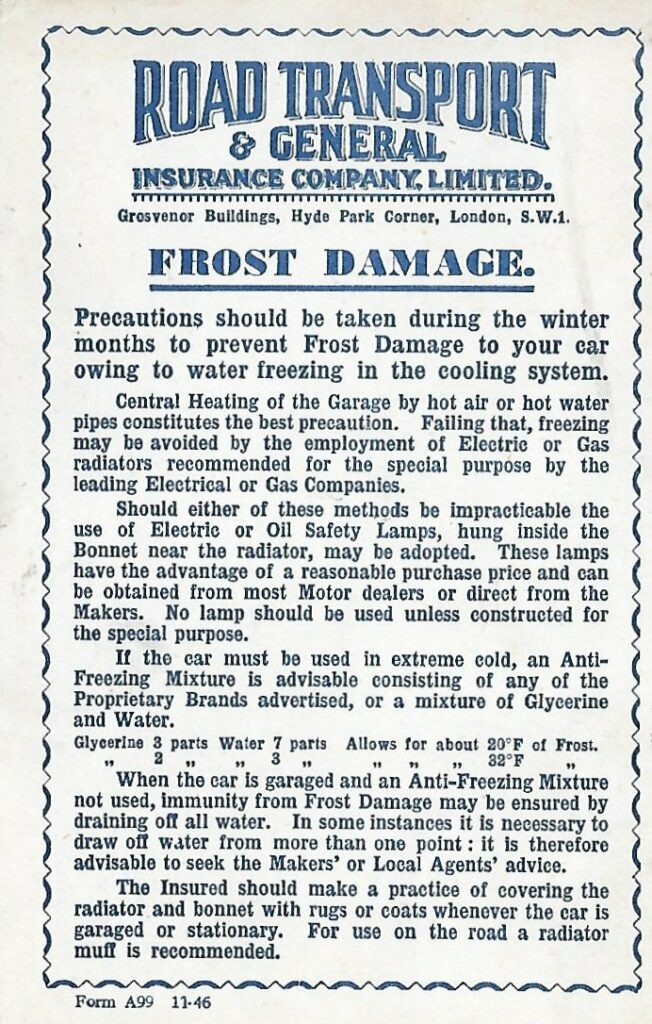

In 1931, the company moved to Grosvenor Buildings 3, Grosvenor Place, Hyde Park Corner. By then, it had an established branch agency network of 35 offices, including one in Norwich, which opened in 1929. Interestingly, 3 Grosvenor Place was the childhood home of the Earl of Airlie, a board director in 1931. It is also the address on my calendar.

In 1967, a final move was made into 77/83 Upper Richmond Road, London. This dates my calendar to somewhere between 1931 and 1967. Despite having some knowledge of its provenance, I have been unable to discover more about the motor trader based near Norwich in Norfolk, to whom it was originally gifted, precisely when it was gifted, or details of his timeline as an agent of Road Transport and General. However, I am aware that this motor trader had agency facilities with several insurers with whom he placed the insurance policies of his many customers.

By the 1970s, the branch network had closed down. Underwriting of commercial business policies had ceased by 1991, when the company began providing motor insurance policies to Automobile Association (AA) customers as part of a panel of underwriters used by their insurance broking arm, AA Insurance Services.

By 1998, Road Transport & General ceased operating as a standalone company when it became part of CGU following the merger of Commercial Union with General Accident. Finally, this insurer, established in the early part of the 20th century by Thomas Tilling Ltd, ceased trading in 2007 when its then owners, CGNU, a company formed by the merger of CGU (Commercial Union and General Accident) with Norwich Union, placed it in liquidation. CGNU was to be rebranded in the United Kingdom as AVIVA in 2009.

This brings to a close the history of one of the many small insurance companies that operated in the UK during the 20th century. Numerous others have ceased trading for many varied reasons during this time, including Provincial Insurance, National Employers Mutual, Iron Trades, and Cornhill (which incidentally was also once owned by Thomas Tilling Ltd.), all of which have fascinating histories worth exploring.

Author: John Lane – Fellow of the Chartered Insurance Institute, Insurance Museum Volunteer and Amateur Insurance Historian

References

https://www.aviva.com/about-us/our-heritage/legacy-companies

https://en.wikipedia.org/wiki/Tilling_Group

https://archive.commercialmotor.com/article/27th-march-1919/7/wheels-of-industry

https://localtransporthistory.co.uk/pioneers/people/tilling/