Irrespective of whether or not they were Prudential customers anyone who can remember England winning the World Cup or the first man to land on the Moon will undoubtedly remember the “Man from the Pru”. This article will explore the origins and work of “The Man from the Pru”. However, to meaningfully do so it is helpful to briefly examine the history of Prudential Assurance Company Limited.

Prudential first began selling life assurance products through a network of local salesmen known as agents in 1848 the year it was founded in London as the Prudential Mutual Assurance, Investment and Loan Association (name changed in 1879 to Prudential Assurance Company Ltd). Initially it provided life assurance products to the wealthy Victorian middle classes. In doing so it adopted the image of Prudence, “the mother of all virtues”, as its company seal.

At this time, the United Kingdom was in the midst of the Industrial Revolution. This period witnessed many people from the countryside migrating into newly built cities and towns, in which new industries emerged and grew, and factories were built to accommodate them. The manual working classes, also known as the “industrious” or “industrial” class, expanded in numbers and began settling in dense urban, sometimes unhealthy areas near the factories.

Unsafe machinery and work processes, together with poor housing conditions for the working class, resulted in many deaths of the family’s breadwinner. A need for financial protection against the costs and hardship endured by the dependants of those people who died from work-related accidents and disease was recognised.

Together with other life assurance providers at that time, Prudential opened its Industrial Branch department in 1854 to sell policies which the working class could afford. These policies were often referred to as “penny policies” because of their very small premiums. The major benefit to the customer of purchasing cover was that premiums were collected from their home by a force of collecting agents. In 1848 when Prudential was established it had a small team of sales agents. However, following their success in selling industrial branch policies it has been estimated that by the beginning of the 20th century, the number of agents working for Prudential had risen to approximately 10,000. Each agent was supported by a network of local district offices of which there were around 500 throughout the towns and cities of Great Britain.

This body of agents, comprising both men and women, was so successful in their work that by the 1960s, it is claimed, six million homes in Britain were visited by a Prudential agent. Most of the products sold were industrial branch policies although the range of products they were trained to transact included home, motor, savings plans, pensions and business policies. To assist them in the sale of pension, savings and business policies, the agent could call on the services of specialist field agents with greater knowledge and understanding of the business in question.

To most of their clients, who were essentially working-class people, the Man (and Woman) from the Pru became not only their financial adviser but often a good friend and helpmate. They were so much part of their community that many agents would provide insurance protection for three generations of the same family. The Prudential agent was so well known and appreciated by his or her customers they would often be invited to the wedding of their children, or sadly, to their funerals.

In his book, The Man from the Pru: Memories of an Insurance Man, retired agent, Brian Holditch explains the official role of a Prudential agent was “to conduct and service all Prudential business in a proper and constructive manner and to sell the company’s policies and deal with any claims in a cordial way”. Unofficially, the duties of the agent extended far beyond this definition.

The Prudential agent was often the only person many people would see from one month to another when they called to collect their premiums. It was not unusual for the agent to switch on the kettle for a cup of tea and listen to their client putting the world to rights. Those clients confined to home would very often use the service of their agent to do the monthly shopping, post letters for them or ask for a lift to a local health centre. In the days of solid fuel fires, it would not be unusual for the agent to leave his or her customer before bringing a full scuttle of coal into their house. Being willing and able to change a light bulb was also seen as a benefit!

At a time when a large proportion of the population was paid weekly in cash and could not readily access bank accounts, credit cards and loan facilities occasionally a Prudential customer would find themselves in financial difficulty. They may have received a sudden unexpected bill such as an emergency repair to their vehicle or repairs to the home. At this time, they knew they could turn to their Prudential agent. Some of the life assurance policies purchased by customers were of a type known as an “endowment” policy. This form of cover not only provided protection should a life-assured die but also had a savings element attached to it. Provided the policy had been in force a minimum of two years it would have a “surrender value”. Depending on how long the policy had been in force this figure may have been much less than the premiums paid. For someone so desperate for immediate cash they would have no alternative other than to decide to surrender their policy.

Despite the financial straits of their clients, it was seen by the agent as imperative that a replacement policy was sold to replace the lapsed one so that financial protection would continue in the event of the death of a family’s breadwinner. For some people who had a limited income and found saving difficult, the agent making their weekly or monthly calls was seen as their only way of being able to save money.

This was not just a Monday-to-Friday job. The Man from the Pru could always be relied on to issue a motor cover note for a client changing their car, or to deal with a sudden death claim during the weekend, or even when they were taking a well-earned holiday.

Many an agent would be a member of their local cricket team or bowls club. This was not only a place where they could relax but also make introductions to potential future clients.

To incentivise the sales force and a way of saying thank you, each year, the top-performing sales agents within each district were invited to the company’s annual “Star Dinner” held at the Chief Office in Holborn Bars in London.

There was great pride in receiving an invitation to the Star Dinner. However, if asked most agents would say that their greatest achievement came from serving their community and looking after clients when they most needed help. Being a Prudential agent was a job for those who worked for the company that became a way of life for them. In addition to a business side to their work, there was a strong social commitment from the agent to their community. They worked at a time when life assurance and insurance products were transacted face-to-face, a time before the internet and mobile telephone with their ubiquitous apps! A time when customers viewed personal service as paramount.

Recognising the vastly changing world of financial services, including transacting life assurance and investment business, in 1992 Prudential began a process of reducing the number of agents working for them. By 2001 their remaining sales force of around 1,600 people, mainly responsible for selling high-value investment products, was made redundant. The “Man from the Pru” finally ceased to exist.

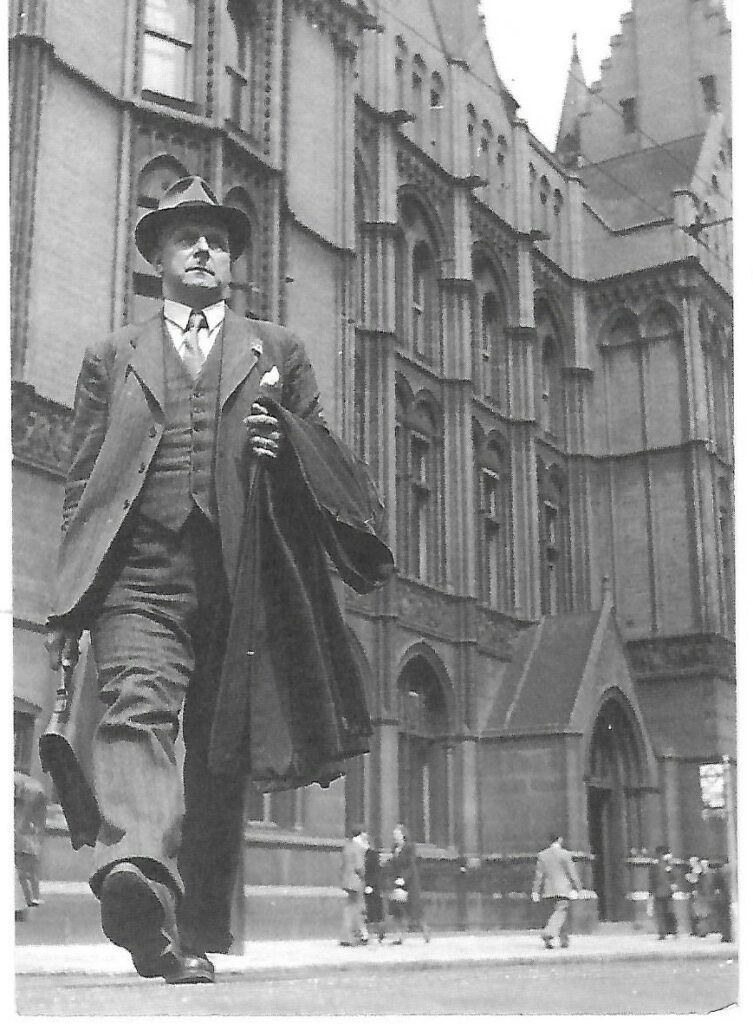

In reading this, some people will wonder if such a person as The Man from the Pru existed. The answer is a very definite “Yes”. The phrase “The Man from the Pru” was first used in 1949 when the London Illustrated magazine ran a feature about the life of a real Prudential agent, Mr Fred Sawyer. One of the pictures taken of Mr Sawyer crossing the road outside Prudential’s chief office was seen by Prudential’s publicity department of the day. It was so striking that the image was used in the company’s publicity in the UK and other markets across the world.

This corporate mark was replaced in 1986 when it was replaced by a stylised image of Prudence. However, despite this modern makeover, for years after many people still referred to their Prudential agent as The Man from the Pru.

By John Lane, Insurance Museum volunteer.

References

The Man from the Pru: Memories of an Insurance Man – Brian W Holditch 2012

http://www.prudentialplc.com>about-us